Market Commentary

Wesley Chapel, FL

Where to begin… I head to Israel for 10 days and all hell breaks loose... Thankfully me and my family are home safely having left just a few days before the reprehensible attack by Hamas. Other Americans were obviously not so lucky. I pray for them and their families during this time. Setting aside nationalism for a moment, I also pray for all of the innocent men, women and children in the impacted and surrounding areas who didn’t ask for this fight but will end up paying the ultimate price through no fault of their own.

I personally don’t know enough about the history of the region to say anything useful or intelligent about political aspects of Israel, Palestine, or their borders. What I do know is that I met many people in my short time there: Israelis, Palestinians, Muslims, Jews, and Christians, who were simply warm-hearted human beings that treated us with kindness and respect. These different people groups all live and work in very close proximity to each other and for the most part, get along just fine.

I don’t necessarily advocate for war, or violence of any kind, but I think I do understand its existence in the world. I call the attack by Hamas on Israel reprehensible because it clearly targeted innocent civilians and I just can’t understand that.

Should Palestine have its own sovereign country? Probably.

Where should the borders be? I have no idea.

Should they murder civilians and kidnap women and children to get it? Absolutely not.

Is Israel any better when they kill innocent people with rocket attacks? Nope.

When things settle down in the region again (which may take longer than normal) I absolutely do recommend a visit to the Holy Land – even if you aren’t religious. There is so much history, culture and interesting geology there - plus the food is amazing!

I know you don’t read this commentary for my opinion on geopolitics or hot vacation spots so I will leave it there. Since there is no real easy transition from that into economics and markets, we’ll just solemnly move on.

You may remember in my commentary last month I wrote that those of you in the market for a new Tesla need not be in a hurry to buy one since it was very likely, based on my analysis, that prices would continue to drop.

Well, as of October 6th, Tesla once again cut the prices of Model 3 and Model Y vehicles. Prices of the highest volume vehicles are down as much as 27% in the past year or so. Those price reductions are cutting into the company’s profit margins as one might expect. I have said for years now that maybe the worst thing that could happen to Tesla is that it succeeds in becoming a mass-market auto manufacturer and with that receives margins and multiples in alignment with the other companies in that industry. That seems to be playing out.

Tesla has begun to lose its “story stock” multiple. It is still wildly overvalued to be sure. Someone out there will surely write me an email to remind me that Tesla is more than an auto manufacturer. It’s an energy company, and an AI company, and a robot company… etc. etc. Look, I get it. Elon still tells a good story. But at the end of the day 95% of Tesla’s revenue comes from selling cars. That is up from 94% last year. I will come back to Elon in a bit.

For now, the more successful they are at selling cars, the lower the margins and multiples will go, and I expect that to keep a limit on the price. Sure, the stock is up a lot this year, but it is also still down 36% from its all-time high in 2021 and still trades at 73 times earnings and 10 times sales - while growing revenue at a slower pace.

Ford and Toyota trade at closer to 10 times earnings while Volkswagen trades at about 5 times earnings. All three of those stocks trade at less than 1 times sales!

Meanwhile, despite all the hype around EV’s taking over the world, Volkswagen has cut production of them due to falling demand… Yes, you read that right.

While I was away, Ken and Ethan joined Kyle for an Elevate Market Chat. There was a little more focus on financial planning than our normal content so if you missed it, you should check it out in the video player nearby. A big “thank you” to those guys for doing a great job in my absence!

TINA has left the building…

No, I am not talking about Tina Turner. For most of the past 10+ years we have used the acronym T.I.N.A. as one way to describe the market situation. It meant, There Is No Alternative to the stock market because interest rates had been driven and held (by the FED) at artificially low levels.

Savings accounts were paying 0% interest, short-term treasuries were paying close to 0%, and after subtracting inflation from these artificially low interest rates, the returns were deeply negative. An investor’s only hope to increase their wealth and purchasing power was to take their chances in the stock market.

Today, savings accounts are yielding around 5% and 3-month US Treasuries are paying 5.5%. So, there is clearly an alternative to taking risk in the stock market. Regular readers know that those risks are very real as I outline many of them in these commentaries.

What should we expect the stock market to return in an average year?

Since the turn of the century, over the past 22 years the market has averaged 5.90% annually. If you consider the Forward P/E of the market which is currently 17.8x compared to the average over the past 25 years of 16.7x, the market is a little overvalued. This would lead to an expectation that the market would perform slightly worse than the average in the coming year.

So, let’s say you can expect to earn 5.90% in stocks albeit with plenty of risk. If you look closely, you’ll see that 7 out of the past 23 years (30% of the time) the market was down. The average loss in those years is -15.92%.

Alternatively, you can earn 5.5% in US Treasuries with virtually no risk.

What are you going to choose?

“Don’t risk money you can’t afford to lose in pursuit of money that you don’t need to make.”

-Porter Stansberry

Increasingly, our clients are choosing to park assets in US Treasuries while we wait for stock market valuations to come down and reflect economic reality. When stocks are cheap, and we have an edge in buying great companies at low prices, I expect many of those same clients to deploy that cash for the long haul. The key is patience.

Stocks, and the stock market in general, can of course rise from here despite already being expensive. Could you handle it if the stock market somehow rises 8%, 9%, or 10%, and you are only earning a little over 5% in treasuries? I can.

I can handle it because the next time the market experiences a significant decline, I expect to buy near the lows and more than make up for any underperformance between now and then. Of course I won’t put all my capital back to work at the exact lows. That is never how it works but that is the idea. And even if I don’t get that part right, it is hard to be too upset about earning more than half of the market return without any risk!

Again, for now, there is finally an alternative for the first time in many years. As investors around the world increasingly decide to opt out of being in the stock market in favor of the alternative, the market could have trouble rising or even fall hard.

Forget the S&P 500 Index, or the Nasdaq Index, or the Dow Jones Industrial Index – what is your family index? Your family index is the only thing that really matters. If you don’t know your family index, you need to find out. Our financial planning experts, Ken, Kyle and Ethan can help you understand your family index, so email us here and we’ll get you on the appropriate calendar.

It is worth considering your personal financial situation and making the best decision for your family – even if that means just staying in the market, at least you will know why you did.

Last month, I covered the difference in return between the S&P 500 Index and the S&P 500 Equal-Weight index. This month, I wanted to take a look at various passive strategies that are typically created in alignment with Modern Portfolio Theory (MPT). MPT is what drives the vast majority of investment advisor recommendations around the world. Very few portfolios are invested directly and only in the S&P 500 Index, yet, this is the benchmark most frequently used to compare portfolio returns with “the market.”

Regular readers know that I believe this is a poor choice of measuring stick, at least right now. It is probably wiser to use the equal-weight version for the time being. But I digress.

Below, I have outlined the returns (for 2022 and year-to-date through October 3, 2023) of four different hypothetical passive portfolios that are constructed with consideration for MPT. These hypothetical returns do not include any type of fee paid to an advisor but do reflect the internal cost of the funds.

Performance of Hypothetical Passive Portfolios

Click image to enlarge

The conservative version has 25% in stocks and 75% in bonds.

The balanced version has 50% in stocks and 50% in bonds.

The aggressive version has 75% in stocks and 25% in bonds.

The risk seeker version (named because MPT says that to choose this aggressive of a portfolio one would prefer higher return without regard for additional risk) has 95% in stocks and 5% in bonds.

A few things stand out.

First, the green box (top right) shows that the S&P 500 Index is the only fund that is up materially for the year 2023. You might also notice that it is not up as much as it was down for the year 2022. Beyond that you will notice that for 2023, all of the versions (red box) of these passive strategies, whether conservative or risk seeking, are basically flat for the year. The conservative version is down 1.41% and the risk seeker version is up 2.92%. Compared to the S&P 500 Index, that seems pretty flat across the board to me.

Another standout is that none of these portfolios are anywhere near making up for how much they lost in 2022. It isn’t even close.

With only 7 stocks driving the entire S&P 500 Index return, 2023 has been an extremely challenging year for actively managed portfolios like the core Growth and Value Strategies we typically recommend at Elevate. When only 7 stocks are going up and pretty much every other stock (exaggerating a little, but not much) is flat or down – it is very difficult to beat the broader S&P 500 (or Nasdaq 100) Index.

But it doesn’t seem to be working any better for passively managed diversified pie charts of funds, which is how most of the world is invested. In fact, those may even look a little worse depending on the day of measurement.

As the market has pulled back recently, we have actively taken steps to increase our exposure to the “Magnificent Seven,” which is what the financial media has taken to calling the few stocks carrying the market this year. But we are doing so with a grain of salt and a great deal of skepticism and caution. Trees don’t grow to the moon. When these stocks stop rising, they could fall hard and fast and we do not want to be overexposed then. But as the saying goes, “if you can’t beat ‘em, join ‘em.” Our stops will get us out early when (not if) the momentum shifts for these companies.

I am sure you have heard about the new “miracle” weight-loss drugs. Often referred to as GLP-1’s or Semaglutide’s, a couple of the most popular products are Ozempic and Wegovy. Both products are made by Novo Nordisk. It is no coincidence that Novo Nordisk is (and has been since May) the largest holding in the Elevate Growth Strategy. We started buying it (this time) all the way back in June 2022 because of the potential of its weight-loss drugs. As you might imagine, the stock is up A LOT.

We have been interested in this idea for a long time. We owned the stock on our Growth Strategy back in 2020 before COVID stopped us out, too. Back then our one-pager said:

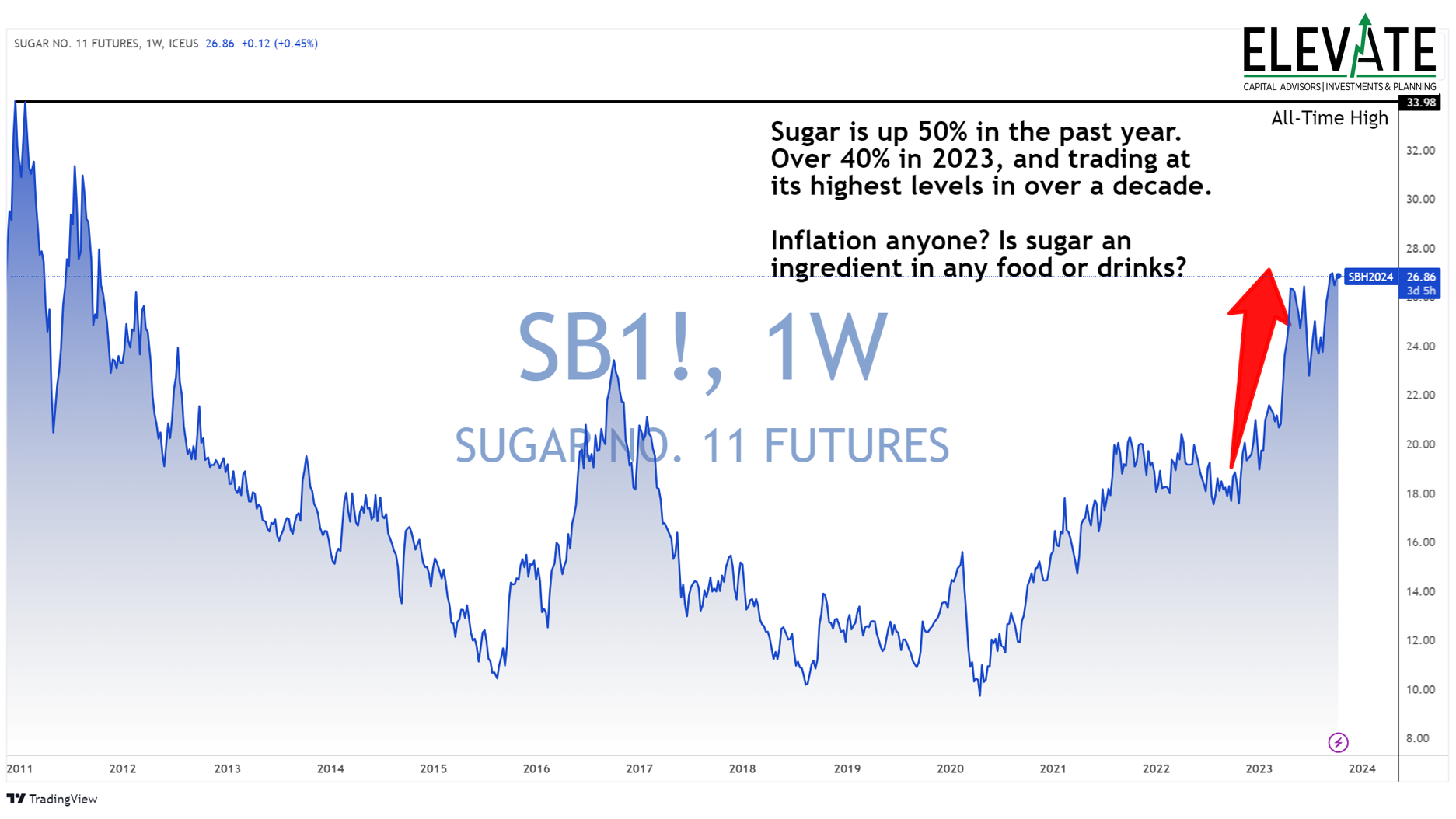

Americans have become less healthy over the past several decades. More of us now consume more calories and sugar than ever before. Meanwhile, we’ve also been less active.

According to the World Health Organization (WHO) the prevalence of obesity globally has tripled since 1975. Along with the rise in obesity, the prevalence of diabetes is skyrocketing. Also, according to the WHO, the number of people with diabetes has risen from 108 million in 1980 to 422 million people in 2014!

All this leads to a huge and growing demand for insulin. Today, Novo Nordisk is the global leader in insulin production with around 50% of the overall market and is the bulk of the company’s business. And while many politicians vilify drug makers for charging too much, insulin is very affordable.

There is a shift taking place in the market from insulin to GLP-1 compounds that is gaining momentum. GLP-1s come with the welcome side effect of weight loss. Thankfully, Novo Nordisk also happens to be the market leader in GLP-1 compounds and recently received approval for the first GLP-1 pill to hit the market – the others are injectable.

Novo Nordisk should benefit from the tailwind of rising global obesity, and it will likely continue to invest in research and development that leads to next-generation drugs. We expect the company to remain the leader in diabetes care for years to come.

Unfortunately, I probably didn’t buy it back as early as I should have after COVID. But better late than never. The trend is intact and is unlikely to change any time soon. On top of the weight-loss benefits these drugs have recently been found to sharply cut the risk of heart attacks and strokes. And just yesterday, Novo said they would stop their kidney disease trial for the drug almost a year early due to having met pre-set criteria for efficacy. That means it works and they can prove it a year earlier than expected.

On this news, the stock of big dialysis companies got hammered. DaVita is down about 22% today and Fresenius is down about 20%.

Another group of stocks that have been impacted by the weight-loss drugs are food stocks. It has been very strange to see some of the most stable, oldest, blue chip consumer staples stocks fall consistently over the past several months on fears that the new drugs will cause people to stop eating salty, sugary, and fatty foods, drinks and snacks.

In my opinion the selloff in these stocks is way overdone. We own several of these stocks because of the addictive nature of their products and the long-term strength and stability of their businesses. I don’t really think it is very likely that people will suddenly lose their addictions to sugar, salt, fat or caffeine because their appetite has been artificially suppressed.

In fact, what I think is more likely is that people on the drugs will lose interest in eating healthy food or trying to follow the latest fad diets.

As a simple example, imagine that someone generally eats three meals each day. The first meal, they try to eat something healthy at home, say some fruit like a banana and maybe some yogurt with granola. Then for the second meal they hit the drive thru at the local McDonald’s for a quick lunch. Later, they make some spaghetti with a salad at home for dinner.

Once this person starts taking Ozempic, maybe they only eat two times per day. And since they are eating less overall because of the drug, they just hit the drive thru twice. They eat fewer calories overall for the day, but since they are eating less overall, they give themselves permission to eat more of what they think tastes the best – and more of the salt, sugar, and fat that they are addicted to. To me, that makes the most logical sense.

Of course, I could be wrong but I did recently get some support for my thesis from the new Walter Isaacson biography on Elon Musk that was recently released. Here are a couple of quotes from the book:

The AI Day rehearsal

After he had been photographed looking blubbery during his two-day Greek vacation with Ari Emanuel, Musk decided to go on the diet drug Ozempic and follow an intermittent fasting diet, eating only one meal per day. That meal, in his case, was a late breakfast, and his version of the diet allowed him to gorge as he pleased for that. At 11 a.m. on Wednesday, he went to the Palo Alto Creamery, a retro-hip diner, and ordered a bacon-cheese barbecue burger with sweet potato fries and an Oreo and a cookie-dough ice-cream milkshake. X helped by eating some of the fries.

-Isaacson, Walter. Elon Musk (p. 497). Simon & Schuster. Kindle Edition.

The Ides of March

“What can be done to make AI safe?” Musk asked. “I keep wrestling with that. What actions can we take to minimize AI danger and assure that human consciousness survives?” He was sitting cross-legged and barefoot on the poolside patio of the Austin house of Shivon Zilis, the Neuralink executive who was the mother of two of his children and who had been his intellectual companion on artificial intelligence since the founding of OpenAI eight years earlier. Their twins, Strider and Azure, now sixteen months old, were sitting on their laps. Musk was still on his intermittent-fasting diet; for his late brunch, he had doughnuts, which he had begun eating regularly. Zilis made coffee and then put his in the microwave to get it superhot so he wouldn’t chug it too fast.

-Isaacson, Walter. Elon Musk (p. 603). Simon & Schuster. Kindle Edition.

Another recent comment that supports my thesis came from Ramon Laguarta, the CEO of Pepsi, on their earnings conference call yesterday. He said:

“So far, the impact [of weight-loss drugs] is negligible in our business.”

In case you didn’t know this already, Pepsi sells many more products than just Pepsi cola… they also own Cheetos, Doritos, Fritos, Lay’s, Cap’n Crunch, Aunt Jemima, Grandma’s cookies, Miss Vickie’s, Tostitos, Ruffles, and many others.

Last week, a Walmart executive said that the company was seeing a “slight pullback” in food purchases, although he didn’t mention which foods… But I can tell you that Walmart’s #1 product is… bananas. So, who knows which products are driving the “slight pullback” that Walmart is experiencing – but it may turn out to be more support for my thesis that weight-loss drugs would more likely cause a reduction in healthy food consumption than unhealthy food consumption. After all, if you can keep eating doughnuts and still lose weight, why would you ever eat peas and carrots? (Yes, I am aware that some people do enjoy peas and carrots – but I am NOT one of them!)

With all that in mind, we have triggered stops on some of our longest-term holdings that I like to think of as “forever stocks,” like Hershey, McDonald’s, and Kraft Heinz. Coca-Cola is also under a lot of pressure. Thankfully we took our profits on Hershey and McDonalds (also Starbucks) near their all-time or recent highs. We have since cut our target allocations and will close the positions entirely if they continue to fall – but we will be looking to re-enter them when momentum shifts back into positive territory. For now, these stocks are technically oversold and due for a bounce, but with the exception of Kraft Heinz, they are still not “dirt cheap.” We are monitoring the situation closely.

S&P 500 Index (SPY) ETF

Click image to enlarge

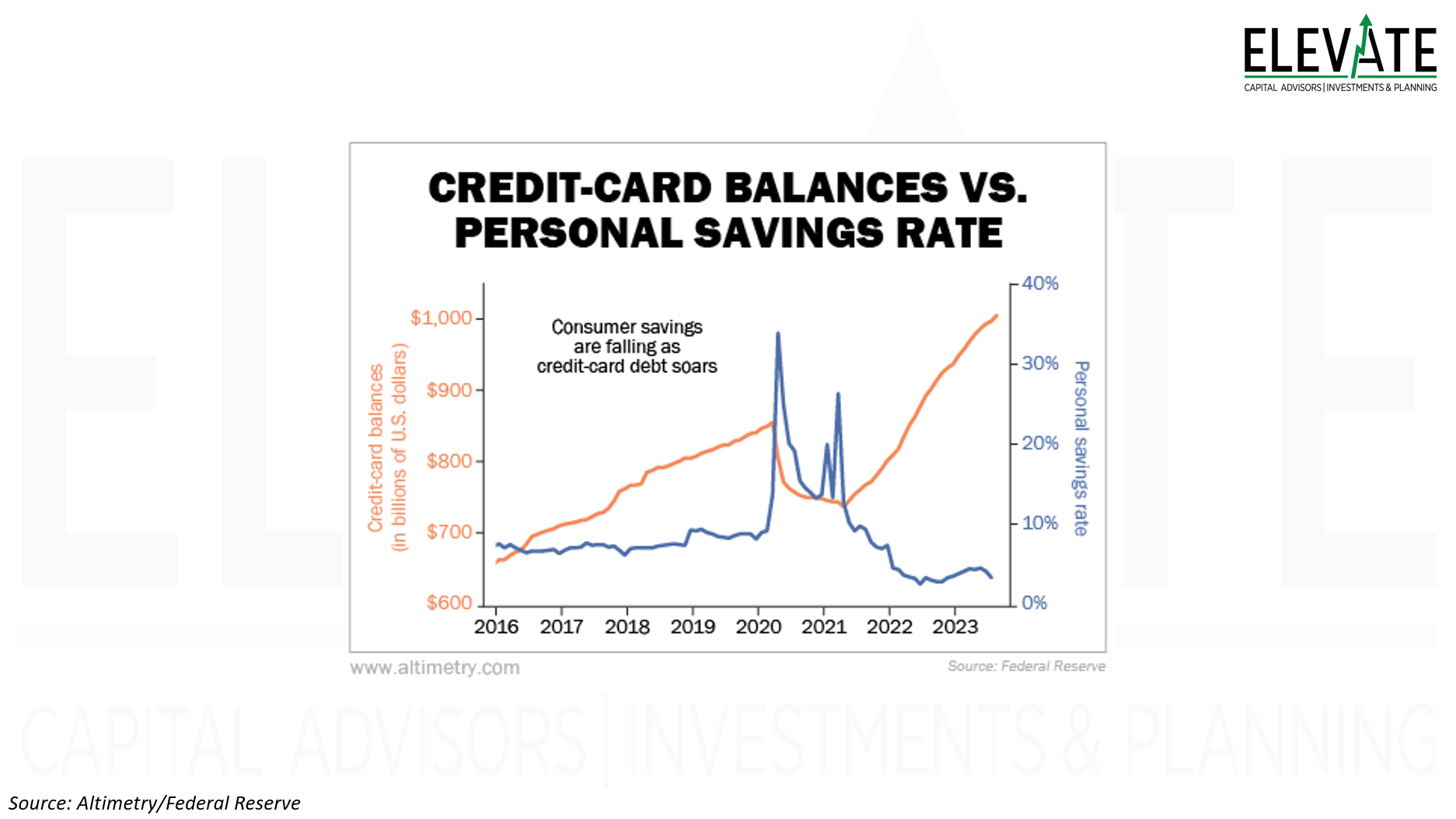

Wrapping up, the S&P 500 was down 5.08% in September and down 6.96% from the intraday high at the end of July. In October, the index has bounced back a little, but I am seeing a series of lower highs develop. For now, the index has bounced off its 200-day moving average, which is to be expected. But if it bounces to another lower high, we could be in for a period of sideways consolidation, or an outright drop below the 200-day moving average, which would be a very bearish signal that could send markets back to the lows for the year. There is also always a chance that the market will breakout to a new high and rally into the end of the year even in the face of higher interest rates, all-time high credit card balances, dwindling savings, high inflation, etc…

At this point nothing will surprise me, and we are well prepared for either scenario. We don’t predict – we prepare.

Remember back in my July commentary when I pointed out that the spread between long-term interest rates and short-term interest rates generally spikes or “reverts” prior to the arrival of a recession? Well, look at what has been happening for the past month or so.

10’s minus 2’s back in July

Click image to enlarge

10’s minus 2’s today - notice the recent spike.

Click image to enlarge

The inflation rate as measured by the Consumer Price Index (CPI) will be released tomorrow morning. The market is expecting 3.6% for the year-over-year headline rate and 4.1% for the year-over-year Core rate, which excludes food and energy… speaking of excluding food - maybe with Ozempic and Wegovy, people eventually just won’t need to eat anymore at all! I wonder if they can develop a shot that will reduce demand for energy too?! Doubtful.

The most important thing to know about these numbers is that neither of them are even close to the 2% target. And this morning another measure of inflation, the Producer Price Index (PPI), came in meaningfully higher than expected.

This data supports the FED keeping interest rates higher for longer and suggests a decline in stock and bond prices.

We also have earnings season starting on Friday with the big banks reporting. This can always be a catalyst for a breakout or breakdown in stock prices. We are looking forward to analyzing all of the reports and updating our fundamental analysis of all the (hundreds of) stocks that we follow.

As has become customary, I will leave you with a few charts & slides:

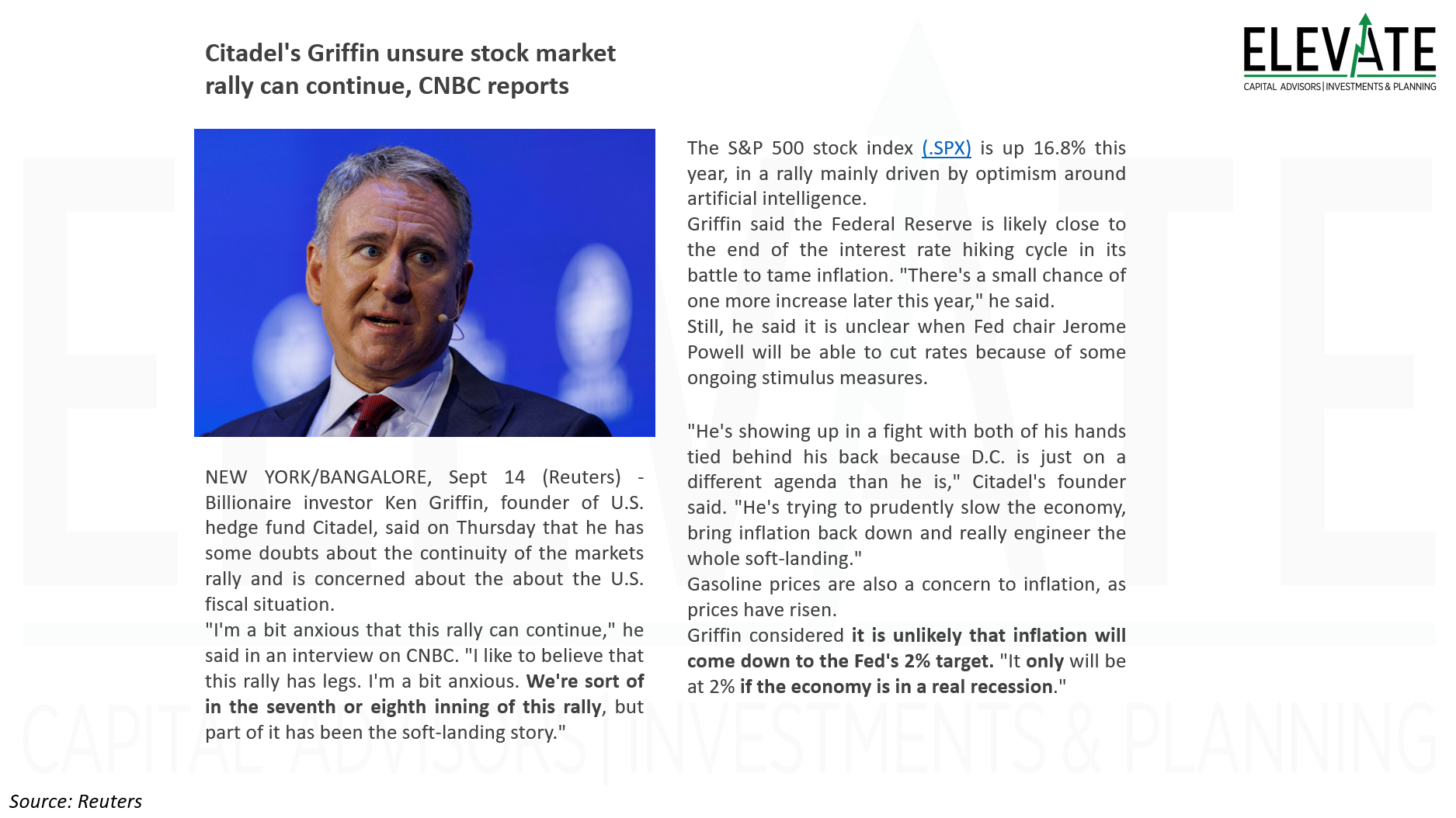

Kenny Boy Griffin

“We’re sort of in the seventh or eighth inning of this rally” - Ken Griffin, Founder of Citadel. Love him or hate him (mostly hate him) he is pretty much the most plugged in human being on the planet when it comes to markets - you might want to pay attention to what he says.

Click Image to Enlarge

As always, there is so much more I could discuss but time is limited so there are things I just have to leave out.

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Clients, I encourage you to click here to access your personalized performance portal to see how your portfolio performed vs. the markets last month.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.