Core Strategies

Scroll down for more

“non-core” strategies.

The Elevate Capital Strategy

Objective: The Elevate Capital Strategy is designed to generate long-term appreciation, or growth.

Goal: The goal of this strategy is to beat/outperform the benchmark (S&P 500) return over the course of a full market cycle.

A full market cycle is measured either from the peak of one bull (up) market to the peak of the next bull market after experiencing a bear (down) market in between. Alternatively, a full market cycle could be measured from the low of one bear market to the low of the next bear market after experiencing a bull market in between. We consider and evaluate our performance using both measurements.

We do not endeavor to make judgements of our performance over any other “man-made” timeframes such as years, year-to-date, quarters, or months.

In pursuit of our objective and goal, we may utilize fundamental analysis, technical analysis, active trading, options, short sales, stocks, bonds, exchange traded funds (ETFs) including inverse and leveraged versions, and rules-based exit/entry signals.

We primarily seek to buy the individual common stock of companies that we can confidently hold forever when they trade at very low prices and multiples relative to their own history, or when they trade below what we fundamentally determine to be the company’s intrinsic value. “Forever” is not to be taken literally. While we expect that we will be able to hold them for a very long time, perhaps multiple generations, even the best businesses with the longest track records have seen experienced periods where we would not have wanted to buy or hold them.

The Elevate Capital Low-Volatility Strategy

Objective: The Elevate Capital Low-Volatility Strategy is designed to generate long-term appreciation.

Goal: The goal of this strategy is to beat/outperform the benchmark (S&P 500) when it is down and capture at least half of the upside return when the benchmark is up, thus achieving lower volatility than the benchmark over the course of a full market cycle.

Non-Core Strategies

The Elevate US Treasury Strategy

Objective: The Elevate US Treasury Strategy is designed to generate the “risk-free” return.

Goal: The goal of this strategy is to produce a higher rate of return on cash than one could earn at a bank.

Since the United States (US) has the ability to print new dollars to pay off debts as they come due, the debts of the US Treasury Department are often referred to as “risk free.” Risk free does not mean that these securities can never lose value, but rather than the government will not default, or be unable to pay the debts bank upon maturity. The price of the securities prior to maturity can, and do move around, both up and down.

The Elevate Momentum Strategy

Objective: The Elevate Momentum Strategy is designed to generate long-term appreciation.

Goal: The goal of this strategy is to beat/outperform the benchmark (S&P 500) return over the course of a full market cycle.

The Elevate Momentum Strategy has the exact same objective and goal as the Elevate Capital Strategy. The difference is in how the strategies seek to achieve these results. While the Elevate Capital Strategy focuses more on fundamental bottom-up, individual company analysis, the Elevate Momentum Strategy focuses solely on technical analysis and invests primarily in exchange traded funds (ETFs), many with leverage.

The Elevate Passive Capital Strategies

Objective: The Elevate Passive Capital Strategy is designed to gain and maintain broadly diversified exposure to global markets.

Goal: The goal of this strategy is to match the performance of asset class weighted performance before portfolio management expenses.

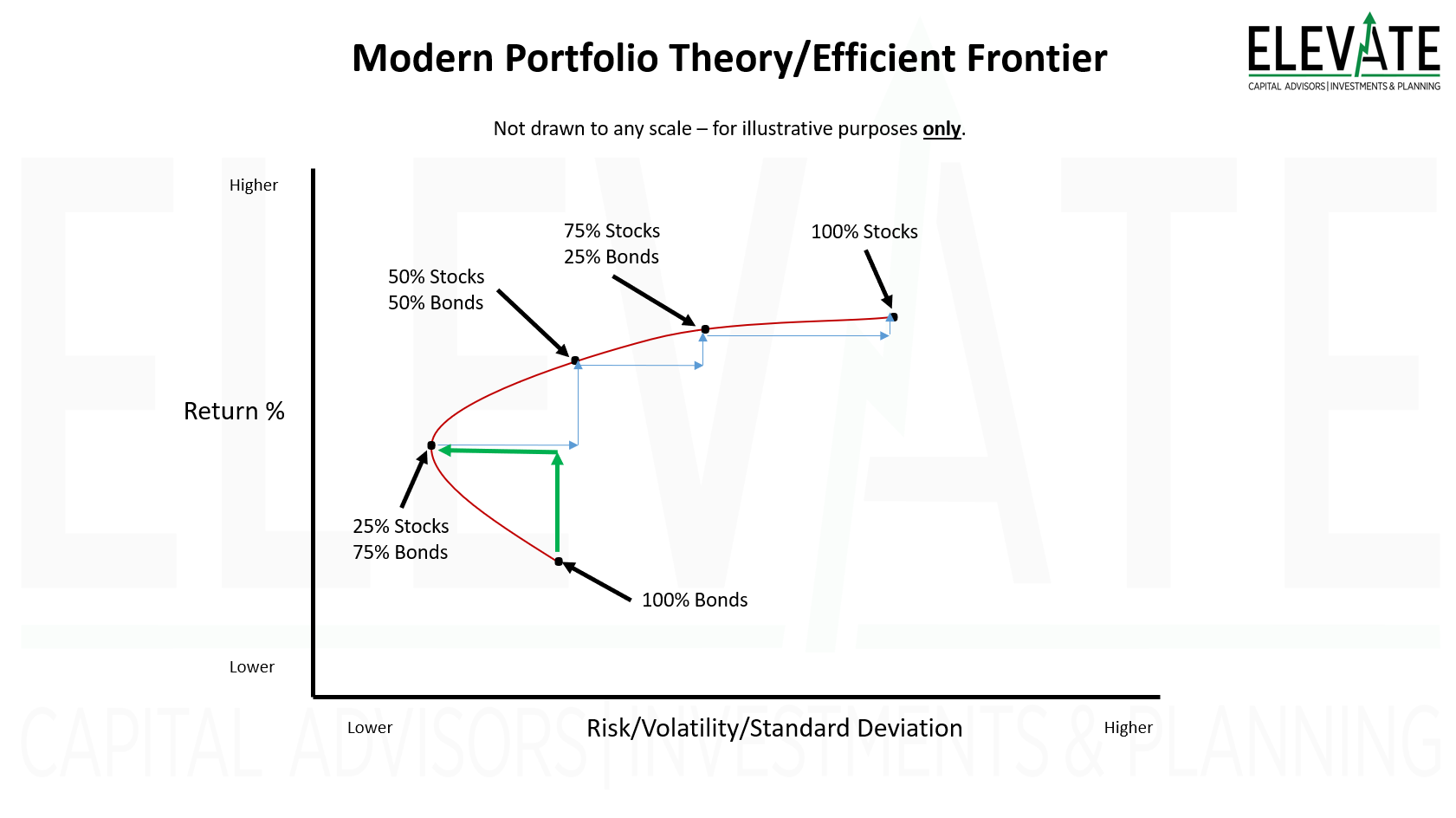

You will often hear us refer to passive strategies as “Pie Chart Prison.” This is how the majority of our competitors in the financial services industry “manage” money. The truth is that there is no real management of the money happening at all, rather it is the client’s expectations which are being managed.