Market Commentary

This month’s commentary explores whether we’re witnessing the early stages of a true SaaS‑pocalypse, or one of the best buying opportunities in years. As always, we focus on asking the right questions and managing risk in an uncertain market.

Market Commentary

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

— Benjamin Graham

Market Commentary

This month, we once again find ourselves at a point where patience and prudence matter more than ever.

Market Commentary

“The further a society drifts from the truth, the more it will hate those who speak it.”

— George Orwell

Market Commentary

“The stock market is filled with individuals who know the price of everything, but the value of nothing.”

— Philip Fisher

Market Commentary

“The function of economic forecasting is to make astrology look respectable.”

— John Kenneth Galbraith. Economist and Author

Market Commentary

There is an old story about Pablo Picasso about a time when he was at a café in Paris and a woman asked if he could do a quick sketch on a paper napkin for her? He picked up a napkin and worked on a sketch for about 5 minutes before handing it back to her. He then proceeded to ask her for a million Francs.

The lady: “It took you only five minutes to draw this!”

Picasso: “No, it took me 40 years to be able to draw this in five minutes.”

This is a clear illustration that the value of something isn’t measured by the time it takes to create it; it’s measured by the skill, experience, and mastery behind it.

Market Commentary

“The world makes much less sense than you think. The coherence comes mostly from the way your mind works.”

― Daniel Kahneman

Market Commentary

"It’s not what you buy, it’s what you pay that counts. Good investing doesn’t come from buying good things, but from buying things well."

- Howard Marks

Market Commentary

I don’t pretend to know where the tariffs will end up. I think the higher they go and the more goods they cover, the worse it will be for the American and global economy. What I do expect is a whole lot more give and take before all the dust settles.

Long-time readers know that the market can handle bad news, but it really hates uncertainty. And right now, there is a lot more uncertainty than “normal,” whatever normal is…

Market Commentary

I actually want to love the tariff idea. It appeals to me and I want to think it will work. The problem is that history is very clear that it will not. In fact, history says emphatically that it is a terrible idea.

The economy works best when the government leaves it alone. Our economy cannot afford our government. Trying to get people in other countries to pay for our government’s reckless spending is a recipe for disaster.

At best, tariffs will be inflationary. At worst, they will cause a depression.

Market Commentary

“In a nation that was proud of hard work, strong families, close-knit communities, and our faith in God, too many of us now tend to worship self-indulgence and consumption. Human identity is no longer defined by what one does, but by what one owns. But we’ve discovered that owning things and consuming things does not satisfy our longing for meaning. We’ve learned that piling up material goods cannot fill the emptiness of lives which have no confidence or purpose.”

-Jimmy Carter, 1979

Market Commentary

“Folks can only fall this deeply in love with such a high level of risk by having absolutely no ability to understand and recognize risk. They're not risk-tolerant... They're risk oblivious.”

- Dan Ferris

Market Commentary

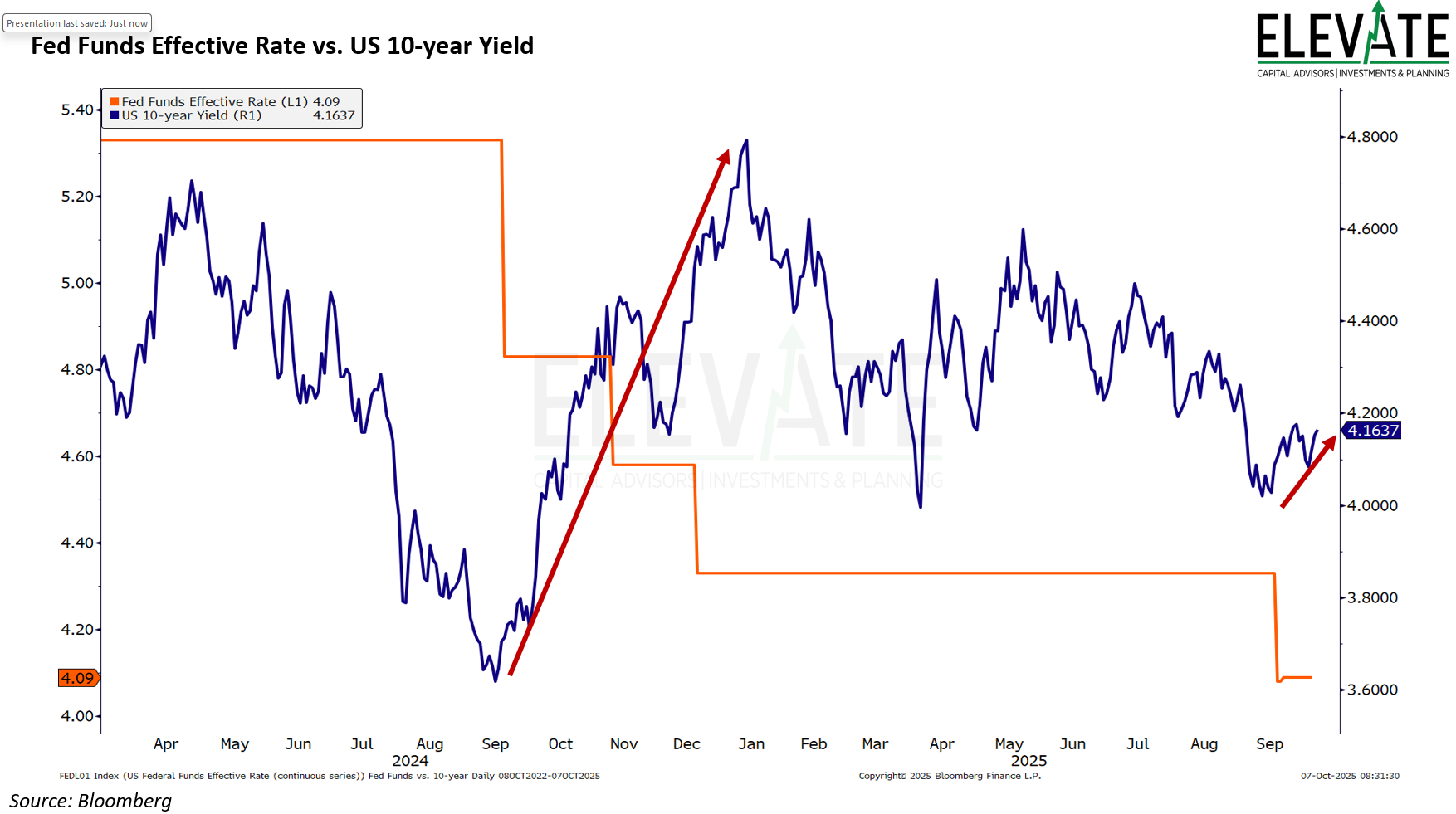

Two days after the election, the Fed concluded its November meeting and decided to cut interest rates by another 0.25%. That moved the low end of their “policy rate” from 4.75% to 4.50%. This is the second consecutive meeting in which the Fed has cut the rate. The last time they met, they actually cut it by 0.50%. Remember, the policy rate, or the Fed Funds rate, is the rate that banks charge each other for overnight loans. So, while you might think that “interest rates” have fallen since the Fed began its most recent campaign to reduce interest rates, you’d be wrong.

Market Commentary

Markets continued their relentless climb in September, with the so-called Magnificent 7 leading the way, up 9.9% for the month. Meanwhile, the S&P 500 was only up 4.2%. What does that tell you about the other 493 stocks?

Market Commentary

"The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy."

-Ludvig von Mises

Market Commentary

The question we need to be asking now is: Was this near correction the first 10% in a more significant move lower, or just a healthy technical correction within the context of a longer-term bull market?

Market Commentary

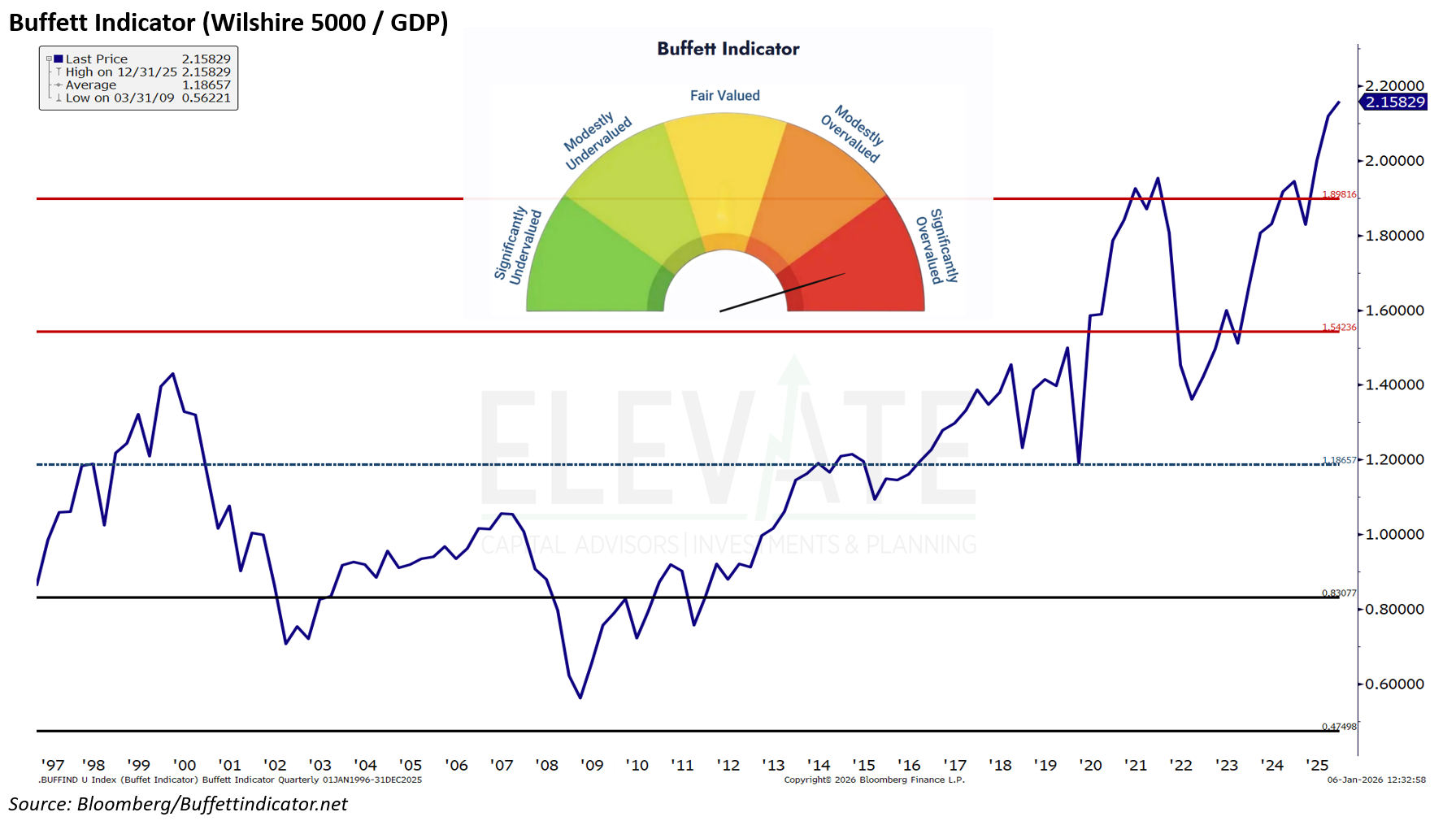

I (Porter) believe we are at an important peak in equity prices... that a big decline in stocks is inevitable... and that buying tech stocks here will lead to poor returns for at least a decade…