Market Commentary

Wesley Chapel, FL

I am going to change things up a little and start off with a few charts that didn’t really “fit” well in the overall commentary this month but are on my mind and worth a quick look nonetheless.

Here we go:

Apparently this is what “falling” inflation looks like…

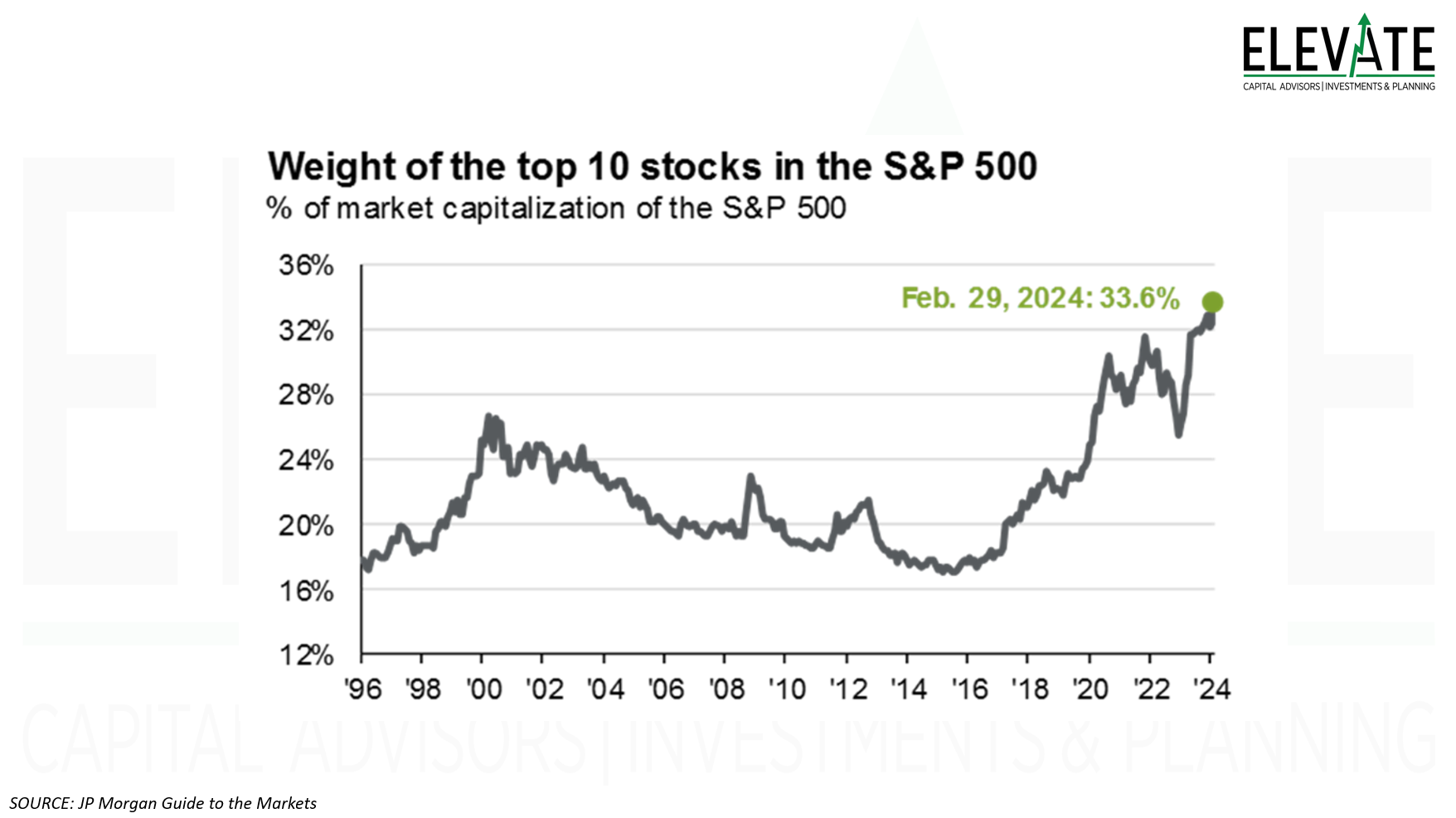

The number of stocks in the S&P 500 that are outperforming the index itself is near the all-time low - not seen since the peak of the dotcom bubble… Nothing to see here.

Looks like Nvidia's (admittedly extremely high and awesome) revenue 🚀 growth rates could be starting to roll over 📉... rate of change matters.

Not all of the Magnificent Seven (Mag7) stocks are created equal… plenty more on this below.

And then there were (the Famous) Four

Wall Street just can’t help itself. First it was the Magnificent Seven. Then it was the Magnificent Six, now we have the Famous Four? Come on!

That’s right, with only four of the seven original Magnificent Seven (Mag7) stocks doing well this year, the financial media is grasping at straws to keep the hype alive. It reminds me a bit of the “FANG” stocks going all the way back to 2013, a term coined by CNBC’s Jim Cramer.

Longtime clients know that I often refer to CNBC as the “Cartoon Network” because it often makes me chuckle. For example, if you listened to Mr. Cramer in January of this year, you would have sold your Bitcoin at $40,000, just before it took off and rallied 70%, but I digress...

The term was a clever acronym (or apronym… the things I learn trying to prepare this commentary) that was easy to remember and speak, ideal for financial media, whose sole purpose of existence is to get clicks and views that sell advertising – not provide quality financial advice or analysis.

Another institution that you shouldn’t trust - your government - uses these clever abbreviations all the time when it introduces new bills and such. Or at least they used to. Now they just give things blatantly false names like the “Inflation Reduction Act” that prints and gives a way a bunch of money, thus literally causing inflation, but I digress again…

The FANG term which originally stood for the stocks of Facebook, Amazon, Netflix, and Google, quickly added an A for Apple to become FAANG. Then in 2015 Google changed its name (but not its ticker symbol) to Alphabet, and it made less sense, but the financial media couldn’t let it go. Later, in 2021, Facebook changed its name to Meta Platforms and it really blew the whole thing up.

A host of other letters for other companies were added and subtracted by various other firms trying to coin a phrase and sell a product along the way as markets changed and stocks rose and fell. All marketing, no financial analysis. But hey, they wouldn’t keep doing it if it didn’t work.

And so it is now with the Mag7, the Mag6 (see last month’s commentary) and the now Famous Four. Eventually, this marketing gimmick will run its course, as marketing gimmicks always do, and we’ll be on to whatever the next one is. But for now, this is what we’ve got.

Ultimately, the Mag7 was born out of the fact that the largest seven stocks in the United States and S&P 500 Index were also the seven stocks that were rising the most in 2023. There is an underlying fundamental reason for this to happen and for it to keep happening, at least for a while.

Active vs. Passive Investing

The underlying idea is that as more and more investors and financial advisors adopt a passive view of the markets, a larger and larger percentage of each new dollar invested via regular contributions to 401(k) plans, Individual Retirement Accounts and other types of long-term investment accounts will find its way into the largest stocks.

These advisors and their clients do absolutely no work to try to discover the real value of anything. They have no opinion on the value of a company or its stock. They don’t even remotely care about the risks associated with paying too much for a company’s shares. They don’t consider if the company’s business is healthy or weak, or what the prospects look like for the future. They essentially assume that someone else has done that work, and if a company wasn’t any good, it wouldn’t be very big. They follow the herd… to its eventual slaughter.

They assume the market is “efficient” and that mispricing never exists, let alone persists for years at a time. They assume that the price you see for the stock is always the same as its real (intrinsic) value. They assume that it is impossible to consistently earn a return higher than the market. I think they assume too much.

If the market is really efficient, it shouldn't matter when you invest or what you buy. If that's really the case, then why not try to do better? As long as you're investing in something, you should do all right, according to these folks. So what's the harm in trying to beat the market?

And here's another way to look at it. The efficient-market folks love to argue that it's impossible for the average investor to beat the market because it's impossible for most people to beat the average result.

At some point, it is a mathematical certainty that not everyone can beat the market. But just because something is "true" on average or across a population, that doesn't necessarily mean it must be true for you.

For example, I might argue... on average, everyone who marries will end up with a marginally attractive spouse of normal intelligence. Therefore, you're probably wasting your time trying to find a beautiful and intelligent person to marry you. In theory, that might be good advice. But was that your dating strategy? If you had dated any dog that would have you, would you have married the spouse you wanted?

In short... when it comes to a lot of important things in our lives, getting better-than-average results is a worthy goal.

-Porter Stansberry

There is also a paradox that emerges from this behavior. The passive investor assumes that the market is efficient because of the work of active investors who work to discover the intrinsic value of a stock, and then buy or sell shares based on whether the market price is above or below their intrinsic value estimate. The active investor expects that other active investors over time will come to believe what they already discovered, and as those new investors buy or sell shares the market price will converge toward the intrinsic value, thereby creating a profit for the original active investor.

Implicit in the passive investor’s assumption that the market is efficient, is that the active investor can identify and profitably exploit inefficiencies in the market and then the passive investor will benefit.

If active investors were not consistently rewarded for exploiting such inefficiencies, they would stop trying and then the market would then become increasingly inefficient such that passive investing would no longer work.

This is known (at least to me and the CFA Institute) as the Grossman-Stiglitz Paradox.

The Grossman-Stiglitz Paradox is a paradox introduced by Sanford J. Grossman and Joseph Stiglitz in a joint publication in American Economic Review in 1980 that argues perfectly informationally efficient markets are an impossibility since, if prices perfectly reflected available information, there is no profit to gathering information, in which case there would be little reason to trade and markets would eventually collapse.

Many great financial minds have expounded on this paradox since 1980 and while I won’t bore you with more details in this commentary, more information is readily available via a quick internet search to anyone who is interested.

Back to the genesis of the Mag7, and the current market environment…

In the first two months of 2024, the S&P 500 Index which blindly invests more capital in the largest companies (i.e., is market cap weighted) is once again (or still) outperforming by a wide margin, the S&P 500 Equal Weight index that invests the same amount of money into all 500 companies regardless of size. As of February 28th, the S&P 500 Index was more than doubling the equal weight index, up 6.84% vs. only 3.01% for the equal weight version. Beyond that, the Mag7 was up 14.04%, more than doubling the S&P 500 return.

Even though I don’t evaluate the performance of our Elevate Strategies on a year-to-date basis, it is interesting to look under the hood at the markets and see what is driving returns. And it seems to me that this passively buying stocks without any regard for their valuation is still in the driver’s seat, for better or worse.

That got me thinking, what if we offered our clients exposure to the Mag7 Index as a compliment to our active management? What would that look like?

Well, it turns out that it is very difficult to predict what the financial media is going to do with the components of the Mag7. For example, they keep cutting the number of stocks based on which are performing well and it is very difficult to objectively track such an index. But what about the original idea behind the Mag7, that the biggest companies are going to continue to attract the most money and that alone will drive the price of those stocks up causing the companies to be even bigger and thus attracting even more capital in a positive feedback loop? If that idea holds, then is there a better way to offer exposure to that idea for our clients?

So, I looked at the Top 10 stocks by market capitalization aka “market cap”, which is simply the value of all the shares of a company’s stock. Then, I looked at how those 10 stocks are performing vs the S&P 500, the S&P 500 Equal Weight, and the Mag7… and wouldn’t you know it, the Top 10 as a group, is doing even better than the Mag7. An equally weighted index of the Top 10 market cap stocks was up 15.94% for the first two months of 2024, vs. 14.04% for the Mag 7.

The thesis seems to hold.

There are some questions about how and when we’ll evaluate which companies are actually in the Top 10, for example, Tesla is currently the 11th largest company and Visa is the 10th largest. But the difference is a few billion dollars and could easily flip back and forth a few times in the near term. We wouldn’t want to buy one and sell the other every single time they flip places over the next several weeks or months.

And we’ll also have to decide when to rebalance back to the equal weights. For example, if one stock rises 50% more than the others, we’ll have to sell some of the biggest company and spread those gains across the other nine.

If you are interested in gaining some exposure directly to the Top 10 Market Cap Index that we have created, please send us an email, or give us a call to discuss how that might work for your portfolio.

Powell Testimony Recap

Jerome Powell, Chairman of the Federal Reserve testified for two days before the House and then the Senate this past week. These are mostly just opportunities for the Representatives and Senators to get up on their soapboxes and give campaign speeches, but there are usually a few relevant takeaways from the chairman. Here are a few:

There is a plan to require large banks to hold more capital to prevent them from failure. It’s called (I kid you not) Basel III Endgame, and I swear it is not the title of a new Marvel movie. Anyway, the big banks have been highly critical of the requirements, look no further than JP Morgan’s recent earnings calls for evidence. Powell told the House of Representatives that there are likely to be “broad and material changes” to the plan based on this feedback from the big banks. He also said they might even scrap the whole thing and go back to the drawing board.

Powell said, “our policy rate is likely at its peak” and alluded to rate cuts coming later this year.

I have my doubts about this panning out… note the significant uptick in so-called “supercore” inflation in the chart at the beginning of this commentary.

He said he sees the recession risks as “not elevated.”

He said that the risks related to commercial real estate loans are “manageable.”

More on this in a moment.

He told the Senate that a digital version of the dollar is a long way off and that there is no way the the Fed would abide by a structure that gives the central bank visibility on how American’s spend their money. He compared that sort of system to what is done in China, not the USA.

That may give you pause – any time the government tells you they definitely won’t do something; your reaction may be (rightly) to at least raise your eyebrows like my business partner Ken. I can appreciate that. The truth is that 89% of US Dollars are already digital… only 11% of money supply is in the form of hard currency in circulation.

The financial markets pretty much shrugged off all the comments as a non-event.

Banking regulation was a bigger focus for the second day of testimony before the Senate because as Powell was testifying that risks in the commercial real estate market are “manageable,” in the House on Wednesday, New York Community Bank (NYCB) was on the verge of failure.

I don’t have the capacity to dive deeply into the situation with NYCB but it is notable that NYCB is the bank that purchased Signature Bank of New York last year when it failed and its stock went to zero. As I mentioned last month NYCB stock dropped 46% when it reported earnings and surprised analysts and investors with a loss of $185 million due to commercial real estate loans that aren’t being paid back.

As Powell was testifying on Wednesday, March 6th, the stock had fallen another 74% from when it reported earnings last month. Poetic, right? At that point the stock was down 88% from its recent high in July 2023, trading at $1.70. There was subsequently news that a group of investors that includes former US Treasury Secretary Steve Mnuchin and Citadel securities were going to invest $1 billion to “rescue” the bank. The stock bounced from its lows but remains down 76% from its highs trading at $3.42/share.

Does that sound “manageable” to you?

Unemployment Rate

The day after Powell’s testimony the unemployment rate for February was released, and came in higher than expected at 3.9%, up 0.2% from last month. The market was initially up on the news because it (mis)interprets this obviously “bad news” as “good news,” which is that the Fed is more likely to cut interest rates. Unfortunately, the market later in the day seems to have realized, even if only momentarily, that the second order effects of people being unemployed is that they don’t have money to passively dump into their 401(k) plans or buy discretionary items… or much of anything else for that matter. The S&P 500 finished down for the day, falling almost 1.5% from its highs in the morning.

Sahm Rule (Recession) Watch

The Sahm Rule, named for Claudia Sahm, has correctly predicted every recession for the past 50 years. The recession indicator triggers when the three-month moving average of the unemployment rate minus the lowest three-month moving average over the past year is 0.50% or greater. Today, it is 0.27%. That is up from 0.20% as of January data, but less than the 0.33% we saw in October 2023.

The more folks talk about how we are past the recession risk, the more likely I think we are to see one happen. Although, my expectation for a recession to begin in the first half of 2024 seems to be a little less likely after the first two months of the year.

What’s in a Headline?

Headline: Fed’s Williams: “The Fed is likely to cut rates later this year.”

Here are some potential interpretations:

Focus on the fact that rates will go down.

Focus on the fact that rates won’t go down until later this year.

Focus on the fact that if rates don't start going down until later this year, that means fewer cuts overall this year.

Focus on the fact that the Fed is signaling that they will have to cut rates in order to maintain maximum employment and stable prices later this year...

I am sure there are even more takes... but those are just a few. The question we should be asking is “why will it be appropriate to cut rates later this year?” Usually, you don’t cut rates unless the economy is in recession and unemployment is high and/or rising rapidly.

“For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young.”

Wrapping Up

This week, we will get more economic data including consumer inflation data for February on Tuesday, retail sales numbers and producer inflation data on Thursday and University of Michigan Sentiment reports on Friday.

Warren Buffett’s annual letter to shareholders was published at the end of February. These letters are pretty much mandatory reading. Check it out here.

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Clients, I encourage you to click here to access your personalized performance portal to see how your portfolio performed vs. the markets last month.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.