Market Commentary

Wesley Chapel, FL

It is feeling a little like Groundhog Day around here…

In last month’s commentary I began with the fact that the second (and third) largest bank failure(s) in the history of our nation happened in March. Well, it’s a new month and a new commentary but the second largest bank failure in the history of our nation happened again in April… for the second time in as many months. This time it was First Republic Bank which was subsequently auctioned off to JP Morgan Chase Bank.

Technically the deal happened on Monday, May 1st, but only after a weekend of bidding took place with the bank already under receivership by the FDIC which puts the failure date as April 28th. There was only one other potential buyer, (PNC Bank) as far as I know.

First Republic Stock Chart

Click Image to Enlarge

Before its failure, First Republic was a bit bigger than Silicon Valley Bank and Signature Bank of New York so the two failures from March slid down the “all-time” list of biggest failures. We can now say that in the past two months we have seen three of the four largest bank failures in the history of our nation. 😒

Don’t say I didn’t warn you. From my last commentary:

“At the end of the day, every single bank on the planet has this same balance sheet problem. There is no escaping it. What the FDIC did for Silicon Valley Bank and subsequently Signature Bank of New York was tantamount to putting a Band-Aid on a broken leg.

These two banks were just the first two dominos to fall.”

And now even Jamie Dimon (the well-respected CEO of JP Morgan Chase) wants us to believe that the worst is behind us. In an article published by the Wall Street Journal on May 1, Mr. Dimon was quoted as saying:

“This part of the crisis is over. Everyone should just take a deep breath.”

I remain skeptical. Apparently, so does the market. Over the following couple of days, PacWest Bancorp (PACW) lost about 50% of its value while Western Alliance Bancorp (WAL) lost about 65% of its value.

Both of those banks have since bounced from their lows on May the 4th but remain down about 30% from the day Mr. Dimon was quoted. WAL is down 54% for the year and PACW is down 73% in 2023.

PACW (blue) and WAL (orange) stock price this year.

Click Image to Enlarge

I guess I am not totally clear on what Jamie meant by “this part.” Was it a reference to only First Republic, or regional bank failures in general? Maybe it will turn out that he was right either way – but for now, there is still plenty of risk that more banks will fail.

The scariest thing about these bank failures is that they are happening while the loans they have made continue to perform, meaning those who borrowed money from the bank continue to make their payments. Just imagine what will happen if (like in 2008-‘09) those clients become unable to make their payments or are unable to refinance the outstanding balances of loans that come due at much higher interest rates.

According to Bloomberg, $1.5 trillion (with a “t”) worth of commercial real estate debt is due for repayment before the end of 2025. The article is worth a read, but perhaps a more reliable source, the Mortgage Bankers Association, indicates that close to $1.4 trillion is due by the end of 2024!

Click Image to Enlarge (Sorry for the poor quality - you can blame the MBA)

Virtually all of that debt was financed at ultra-low rates and assuming it is even able to be refinanced, which I sincerely doubt, it will be done at the prevailing and much higher rates that we see today. If borrowers begin to default on those loans, we “ain’t seen nothin’ yet,” as the saying goes.

Another reason it feels like “Groundhog Day” is because of the buzzwords I keep hearing. I pointed out last month that the Secretary of the US Treasury Janet Yellen stating that our “banking system is sound” while testifying before congress was eerily similar to then Secretary of the US Treasury Henry Paulson saying virtually the same thing back in 2008… just before the Great Financial Crisis (GFC.)

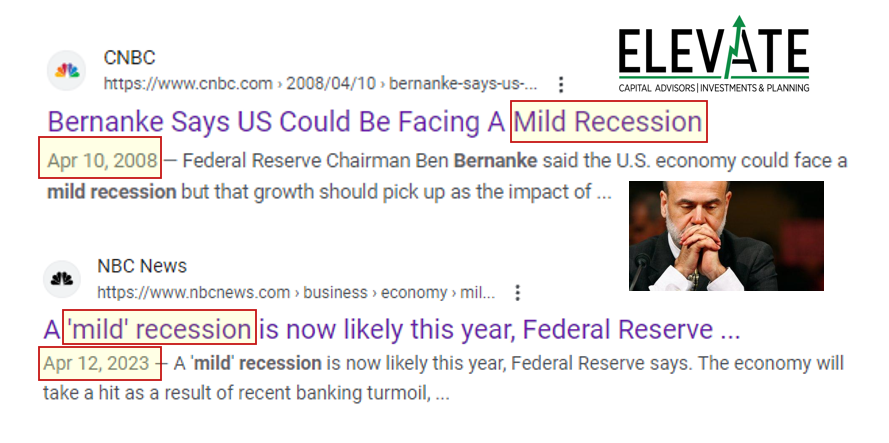

Well, now we have the FED on record as expecting a “mild recession” just like then Chairman of the Federal Reserve Bank Ben Bernanke did back in 2008… I think we all know how that turned out.

You can’t make it up.

Anyone who thinks these government agencies don’t have standard talking points or a go-to playbook isn’t paying attention. It could hardly be more obvious.

Of course, the FED could be right and maybe we’ll only see a mild recession. But it could also be very wrong (think, ‘inflation is transitory’) and the seemingly imminent recession could be the worst we’ve ever seen. The truth is that they have no idea.

As of this morning, most of the companies in the S&P 500 and the NASDAQ 100 had reported their quarterly earnings. For the second quarter in a row earnings were down from the year prior. Profits for S&P 500 companies were 3.23% lower and 8.50% lower for the NASDAQ 100. Notably, the technology sector within each index was down over 8%.

Click Image to Enlarge

Source: Bloomberg h/t Hedgeye

So, the second consecutive quarter of declining profits qualifies in my book as an earnings recession. I will be surprised if that isn’t followed up with a full-on economic recession, usually defined as two consecutive quarters of declining GDP. The last time that happened (in 2022) the government decided not to officially declare a recession.🤷♀️

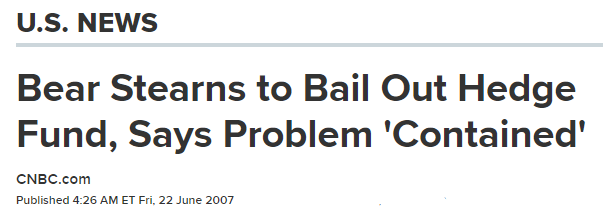

The stock market seems to be mostly shrugging off the bad data, for now, much like we saw back in 2008 after JP Morgan bought Bear Stearns after it failed. Back then the market listened to the talking points of Bernanke, Paulson, and others, then rallied for several months before things really started getting ugly. I think something similar is happening today.

Click Image to Enlarge

I’d also like to note that even Bear Stearns had the ‘talking points’ back then… in June of 2007 they bailed out a hedge fund they did business with and said the problem was contained only to see their bank fail 10 months later. But for those 10 months, everything was “fine.”

Back to present day, when I look at the charts of the S&P 500 and NASDAQ 100 indexes (using SPY and QQQ) standard technical analysis is very bullish. If I knew nothing about fundamental analysis, I’d be buying stocks like crazy and holding no cash. I might even borrow money to buy more stocks.

SPY Chart

Click Image to Enlarge

Even the 200-day moving averages for both indexes have started to move higher, which can only mean one thing – we are in an uptrend. But I fear that this uptrend is within the confines of a bear market, and likely a recession, which means despite the very bullish technical picture it is still not time to get aggressive about buying stocks.

QQQ Chart highlighting 200-dma in blue

Click Image to Enlarge

QQQ Chart highlighting 200-dma in blue

Click Image to Enlarge

If we really are in a new bull market, we will have plenty of opportunities to buy on dips as the market grinds higher and higher.

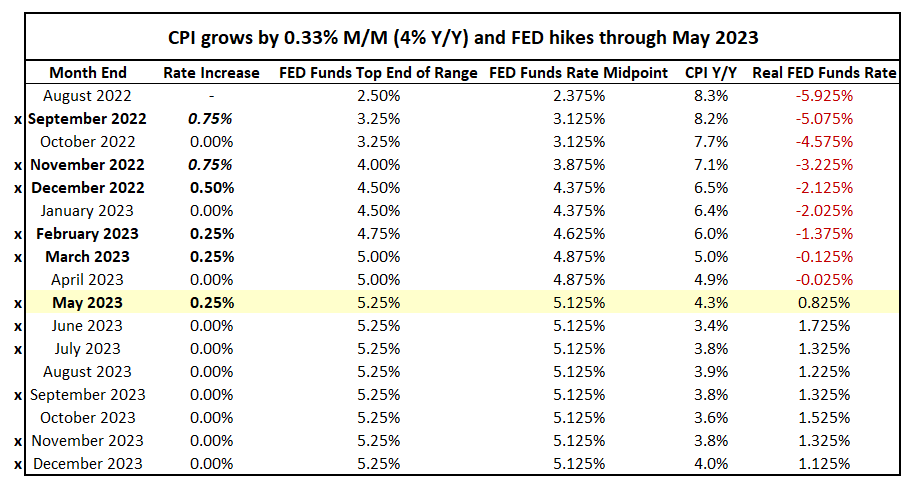

Last week, amidst the backdrop of large banks failing left and right the FED decided to hike the overnight lending rate (the FED Funds Rate) once more by another 0.25%. The current top end of the range for FED Funds stands at 5.25%.

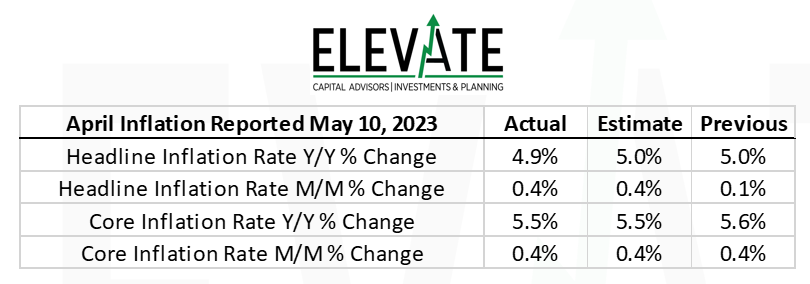

This morning, the annual rate of inflation in the United States (CPI) was reported for April at 4.9%.

If we start with the midpoint of the current target range (5.00%-5.25%) for the FED Funds Rate of 5.125% and then subtract the most recent inflation rate (for April) of 4.9%, we get a positive “real” FED Funds Rate (0.225%) for the first time in a very long time.

In simple terms, this means the FED’s policy is finally restrictive, but only very slightly.

Historical and projected “real” FED Funds Rate

Click Image to Enlarge

As I have been writing since at least October 2022, the FED has never stopped a rate hike cycle with a negative real FED Funds Rate. Now that they have gotten to a positive real rate, albeit ever so slightly, I do think it is likely that they will hit the “pause button” on further rate hikes, at least for now.

When the FED met last week, they changed one sentence in their press release that Chairman Powell also commented on during his post-meeting press conference. This also suggests they may pause rate hikes at their next meeting in June.

That sentence, in the March press release said:

“The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

Last week, the press release said:

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time…”

Regarding the change in language, Mr. Powell said:

“A decision on a pause was not made today. You will have noticed that, in the statement from March, we had a sentence that said, ‘the Committee anticipates that some additional policy firming may be appropriate.’ That sentence is not in the statement anymore. We took that out and, instead, we're saying that ‘in determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account certain factors.’ So that's a meaningful change that we're no longer saying that we anticipate, and so we'll be driven by incoming data meeting by meeting. And, you know, we'll approach that question at the June meeting.”

In that comment he made it clear that there has been no advance decision to pause rate hikes. Complicating the matter, inflation numbers were reported this morning and the Core Inflation rate, which excludes Food and Energy prices, was once again higher than the headline CPI rate of 4.9%. Core inflation was reported at 5.5% for the month of April, unchanged from March.

The stock market initially rose about 1% this morning when the inflation rates were reported, but then quickly gave up those gains falling nearly 1.5% (to the lows of the day) from the pre-market highs, before rallying again into the close.

So, we’ll see what happens in May. If inflation remains stubbornly high, or begins to reaccelerate, the pause might not even happen.

Meanwhile, based on FED Funds Futures Mr. Market thinks that the FED will cut rates later this year. Powell was asked about this during the press conference and his response was clear (with emphasis added by me):

“On the Committee, have a view that inflation is going to come down, not so quickly, but it'll take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates, and we won't cut rates.”

I think the only way that the FED would cut rates this year is if the market is in freefall, as in down 20% or 30% from here. And if they did cut rates, inflation would just reaccelerate, which would be worse in the long run.

Inflation is at 4.9% (arguably 5.5% using the core number) vs. a target of 2%. We aren’t even close yet. Our economy needs rates to stay higher for longer. That should mean lower profits, lower GDP, and lower stock prices; but also lower inflation.

There is nothing more expensive than “free” money as we have all found out over the past couple years.

M2 is the U.S. Federal Reserve's estimate of the total money supply including all of the cash people have on hand plus all of the money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs). Retirement account balances and time deposits above $100,000 are omitted from M2.

When more money is printed and makes its way into the financial system it causes inflation. The more dollars in circulation, the more dollars it takes to purchase goods and services, and vice versa.

As we can see on the following chart, the spike in M2 during 2020-‘21 coincides with the COVID economic shutdowns and directly translates to the banking crisis we are seeing today. I covered this in detail last month. All that cash had to go somewhere. It went to the banks. Those banks bought bonds at ultra-low interest rates that are now worth 50 cents on the dollar due to much higher prevailing interest rates.

Click Image to Enlarge

Source: Federal Reserve Bank of St. Louis

We are in uncharted territory here. We have never in the history of our country seen a sustained decline in M2, let alone one of this magnitude. Nobody knows what will happen, but the implications are fairly straightforward. If printing all that money and giving it away saved us from economic collapse in 2021, what impact should pulling all of that money out of circulation have?

Q&A

Not all financial companies are created equal and because of the prevalence of ETFs these days, some financial companies can drop in price just because market participants are selling the funds that own them. I think there are more than a few stocks in the Financials Sector that are currently feeling pressure related to the banking crisis even though their business has little to do with traditional banking. This is the proverbial baby getting thrown out with the proverbial bathwater, as it were.

One such company is Charles Schwab (SCHW), where we have around $125 million of Elevate’s assets under management (AUM). This is just a drop in the bucket of the $7.58 trillion that Schwab holds onto for firms just like ours and investors just like you.

We have received a few questions from our clients regarding Schwab’s financial stability considering the banking crisis that continues to unfold and the financial media who love to write up poorly researched hit pieces.

Below is from an email response to one of those questions that was originally written on May 4th. You can find the complete attachments with supporting details here, here, and here.

I don’t think it is any “secret” that banks are insolvent. It is simply the nature of the banking business. The bet is that customers will not, on average, ask for all their money back at the same time. And for the most part, that is the way it works. But occasionally, confidence is lost for whatever reason and a bank run ensues.

Deposits over and above the FDIC insurance limit of $250,000 are those which tend to flee first in the event of a “crisis of confidence” in any bank.

Approximately 86% of Schwab’s bank deposits are FDIC insured.

Before Silicon Valley Bank failed only about 7% of its deposits were FDIC insured, for comparison.

When deposits flee, they must go somewhere.

Schwab saw Net New Assets of $132 billion in the first quarter 2023, including $54 billion in March alone.

Many of our clients participated in these inflows as they moved money from small regional banks to Schwab so that we could buy US Treasuries for them.

Schwab’s average years to maturity for its investments is about 2.75 years. Most banks hold longer-term securities than that with Silicon Valley Bank’s recent average at over 6 years.

I don’t think Schwab has the same risk of deposit flight as a traditional bank. People give money to Schwab for longer-term investments while they tend to keep money at traditional banks that they want ready access to at all times.

I believe Schwab has the capacity and enough access to liquidity from other sources to hold all of its Held-to-Maturity (HTM) securities to their respective maturity dates.

There is nothing wrong with GAAP’s treatment of HTM securities (valued at cost instead of market prices) so long as they are actually held to maturity.

Only about 8% of Schwab’s “liabilities” comes from Checking and Savings accounts while at a traditional bank checking and savings accounts represent substantially all of their business.

Again, Schwab is not a “large bank.”

Schwab paused its planned share repurchase program in Q1 to conserve cash in anticipation of regulatory changes. They did this despite raising their quarterly dividend payment.

“Maintaining the capital and liquidity required to support Schwab’s long-term growth remains our primary balance sheet objective.

We increased our quarterly common dividend by 14% to $.25 per share and returned capital via common and preferred stock repurchases. Even with the accelerated capital return during the first two months of the quarter, our Tier 1 Leverage Ratio finished at 7.1%. In light of recent events within the U.S. banking sector, and the resulting regulatory uncertainty, we have decided to pause our active buyback program. That being said, opportunistic capital return is still an important component of our ‘through the cycle’ financial formula.

Ultimately, we believe the current headwinds will prove transitory and we remain well positioned to deliver long-term value to our stockholders.”

-Schwab’s CFO, Peter Crawford

Schwab insiders have personally purchased around $4.5 million dollars of stock since March 14th, 2023. ~$3 million of that was the CEO. These insiders collectively have ~$66 million invested.

We don’t actually hold that much cash at Schwab, for our clients.

The money that we keep at Schwab is virtually all invested in something, whether shares of stock, an ETF, or a US Treasury security. This means we don’t have any risk associated with Schwab’s failure in these securities. We are diligent about reinvesting cash from matured treasury securities into new ones. Our risk is more related to the United States of America paying its bills than anything else. So, while we are focused on the debt ceiling debates, I am confident that will get worked out as it always has in the past. For now, the uncertainty and political brinksmanship is providing us with handsome rates of return on short-term treasuries.

At the end of the day, I am not going to say that it would be impossible for Schwab to fail. Anything can happen. But I think it is an extremely low probability and in the event of it happening, we would still own all our securities. They would likely be taken over by another financial institution in the event of a failure. If not, we’d have to find a way to transfer them to another custodian, just like Schwab. We (Ken and I) have worked with many custodians throughout our careers and as Ken has heard me say often, “I hate all of them, just for different reasons.”

We don’t take lightly the fact that we have over $120 million of client assets at Schwab. We made the decision to consolidate our client accounts there because Schwab is “the 800-lb gorilla,” in the space. And because they possess very strong financial stability. We do pay close attention to what they are doing, and we keep up with their financial reporting. We also have the benefit of seeing trends as they develop, firsthand, through our clients and our own decision to consolidate our accounts there after splitting between Interactive Brokers and Schwab for the past several years.

For what it is worth, we are actively accumulating shares of Schwab stock (SCHW) in our Growth Strategy. We have a stop loss in place if shares were to continue to slide (as always) but I think the shares represent an extremely attractive investment in the long run. Again, I don’t think Schwab ought to be considered the same way as a traditional bank. Sure, they have a banking business, but it is extremely small in relation to the $7.58 trillion (with a “t”) of client assets they hold and invest.

Tom Damon

Lastly, I want to introduce the newest member of the Elevate Team, Tom Damon (duh-moan). Tom joined us on March 20th as an Investment Operations Associate and has already begun to add tremendous value to the team – including editing this commentary! He will mostly operate behind the scenes so you may never actually talk to him, but I can assure you he’s a real person and not some sort of AI Chatbot…

Mr. Damon was born and raised in New York City. In 2018, he received his Bachelor’s degree from the University at Albany. Tom majored in Business Administration with concentrations in Finance and Marketing and minored in Economics.

Prior to joining Elevate, Tom was an associate to a high producing financial advisor at Northwestern Mutual and quickly obtained his Series 7 and Series 66 licenses. This is where he developed a large interest in investment management and planning. At Elevate, he overlooks all aspects of investment operations as well as assists with portfolio management.

Tom currently resides in Brooklyn, NY where you can find him soaking in all NYC has to offer before he finally decides to move somewhere quieter and warmer. He also loves to lift weights, spend time with family, and play video games.

Feel free to shoot him an email to say hello!

Clients, I encourage you to click here to access your personalized performance portal to see how your portfolio performed vs. the markets last month.

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.