Market Commentary

Wesley Chapel, FL

“The further a society drifts from the truth, the more it will hate those who speak it.”

We published my last commentary on September 9; the next day, Charlie Kirk was assassinated. Charlie was, without a doubt, a brother in Christ and someone for whom I had immense respect. He wasn’t Jesus; he wasn’t perfect, and I am sure that if given the opportunity, he would have acknowledged that himself. Nevertheless, he did not deserve to be killed, especially in such a cowardly manner, as he was genuinely welcoming to anyone who disagreed with him. I mention Charlie Kirk for two reasons. First, his assassination is a moment I don’t think I will ever forget. There are various aspects we can discuss if you want to send an email and ask me about it. Second, I believe it could serve as an early warning sign of what is to come, largely due to our country’s economic policies over the past several years.

Without getting too far into the weeds, I will simply assert that economics can start civil wars. The US Civil War is a prime example. I know, you have been taught that it was only about slavery. I won’t go as far as to say it had nothing to do with slavery. Please understand me, slavery is beyond evil and well worth fighting over, but I can tell you that the “Tariff of Abominations” in 1828 led directly to South Carolina’s threat of secession. This was the first outright threat of secession in our country’s history and was the direct result of tariffs and nothing else.

At the time, the US Government relied heavily on tariffs for revenue, as there was no income tax, which was never contemplated in the original Constitution. The tariffs protected northern manufacturers by making imported goods more expensive. The southern states imported many goods from Europe and exported much of their cotton. Southerners argued that tariffs favored industrial interests in the northern states at the expense of the southern states.

Interestingly, the first income tax was passed in 1861 for the express purpose of funding the (civil) war effort. And the federal income tax wasn’t permanently established until 1913 with the ratification of the 16th Amendment to the Constitution.

There is more to the story, of course, and you can read more in this essay, “The Nullification Crisis” on the Bill of Rights Institute website.

An economy that does not serve 90% of its citizens, particularly young adults, leads to troubling consequences. For instance, the unemployment rate for individuals aged 20-24 is currently 9.2%. When young people see no viable economic pathway to owning a home, starting a family, or getting out of debt, they may feel as if they have nothing to lose. This sense of hopelessness can lead to unpredictable behavior, including extreme actions like assassinating those they don't like or disagree with.

There is, of course, no excuse for that sort of behavior. However, it is something to consider. Nothing has ever scared me more than people who think they have nothing to lose. Every day, thanks in no small part to the economic policies of our government (under both left and right leadership), the number of people fitting that description is steadily increasing.

Stock markets had an unusually strong September with the S&P 500 rising 3.5%. The benchmark index is now up 13.7% year-to-date, led, as regular readers know, by the biggest and most expensive stocks in the index. The so-called Magnificent 7 and the Top 10 are up 18.2% and 18.0%, respectively.

The ten largest stocks in the S&P 500 now account for 40.4% (!) of the index- another all-time high. These companies now trade at a Forward P/E multiple of 29.9, about 45% more expensive than normal, and about 53% more expensive than the “forgotten” 490 companies.

The far more diversified Equal Weight version of the index was only up 0.9%, less than half as much, for the month, and only up 8.4% so far in 2025.

Remember, the S&P 500 is sold to investors by Wall Street as a diversified index, but more than 40% of every purchase is landing in 10 stocks that are 50% more expensive than the average of the other 490. The top two stocks alone (Microsoft and NVIDIA) are now 14.7% of the index all by themselves. And their Forward P/E is an almost unbelievable 37.5. That is 92% higher than the average of the forgotten 490.

Q: Since when did putting so much money into the most expensive stocks lead to the best long-term returns?

A: Since never. And I suspect this time will not be so different.

Meanwhile, gold, our largest holding at Elevate (excluding treasuries), once again stole the show, up another 11.9% in September. Gold is now up 47% year-to-date, leaving all the other indexes we follow in the dust.

Q: Why is gold rising so relentlessly?

A: Well, the simple answer is that everyone wants to buy it and nobody wants to sell it. And that includes central banks around the world that used to hoard US Dollars and US Treasuries. But no more. Now, they want to own gold because they see the writing on the wall for the debt situation in the US. We are now running a $6 trillion annual deficit in a time of peace and relative prosperity. If our government can’t balance the budget under these conditions, when will it ever be able to?

We haven’t been officially tracking Bitcoin in this commentary, but it is also having a great year. Not as great as gold (wink), but at 33% year-to-date through 10/6, it is still beating (and nearly doubling) the major stock indexes. Yesterday, Bitcoin achieved a new all-time high of over $126,000.

Q: What are gold and Bitcoin trying to tell us?

A: Some wicked inflation this way comes.

Inflation is still running hotter than the Fed’s 2% target and seems to be accelerating. The last time inflation was below 2%, using the Fed’s preferred inflation gauge, was all the way back in February 2021.

After nearly a year of keeping its policy rate unchanged, the Fed resumed its cutting cycle last month, as expected, when it reduced the rate by 0.25%. And with the current Fed Chair, Jerome Powell, on his way out in favor of a more dovish (i.e., more likely to cut) replacement, it is very difficult to see inflation falling below 2% anytime soon.

The Fed has seemingly begun to float trial balloons about switching from a precise target to a “range” target, due to its nearly five-year failure to achieve its goal, despite what it initially told us was “transitory” inflation.

And of course, the consistent message from the Fed has been that it will not raise the 2% target. All I can say is that none of us should be surprised when they do precisely that.

While I am on the topic of inflation, it is worth noting that these 2% and 3% numbers are nonsense anyway. Unfortunately, I must pay attention because the market reacts to them. But they are totally made-up numbers. For example, when the Bureau of Labor Statistics (BLS) is unable to collect a price for an item in a specific geographic area, it uses a method to estimate the missing price based on prices collected from other regions.

Since September 2019, about 12% of the data has been estimated. In August 2025 (reported in September), 36% of the data was estimated! That’s three times the normal rate.

Meanwhile, the Chapwood Index, which collects data on 150 everyday items in 50 major cities, reports that the inflation rate in Denver, Colorado, for last year (2024) was 9.98%. In New York City, it was 13.16%. If you, like me, have bought a single item of any kind over the past couple of years, you know as well as I do that the Chapwood Index is way closer to reality than the government CPI.

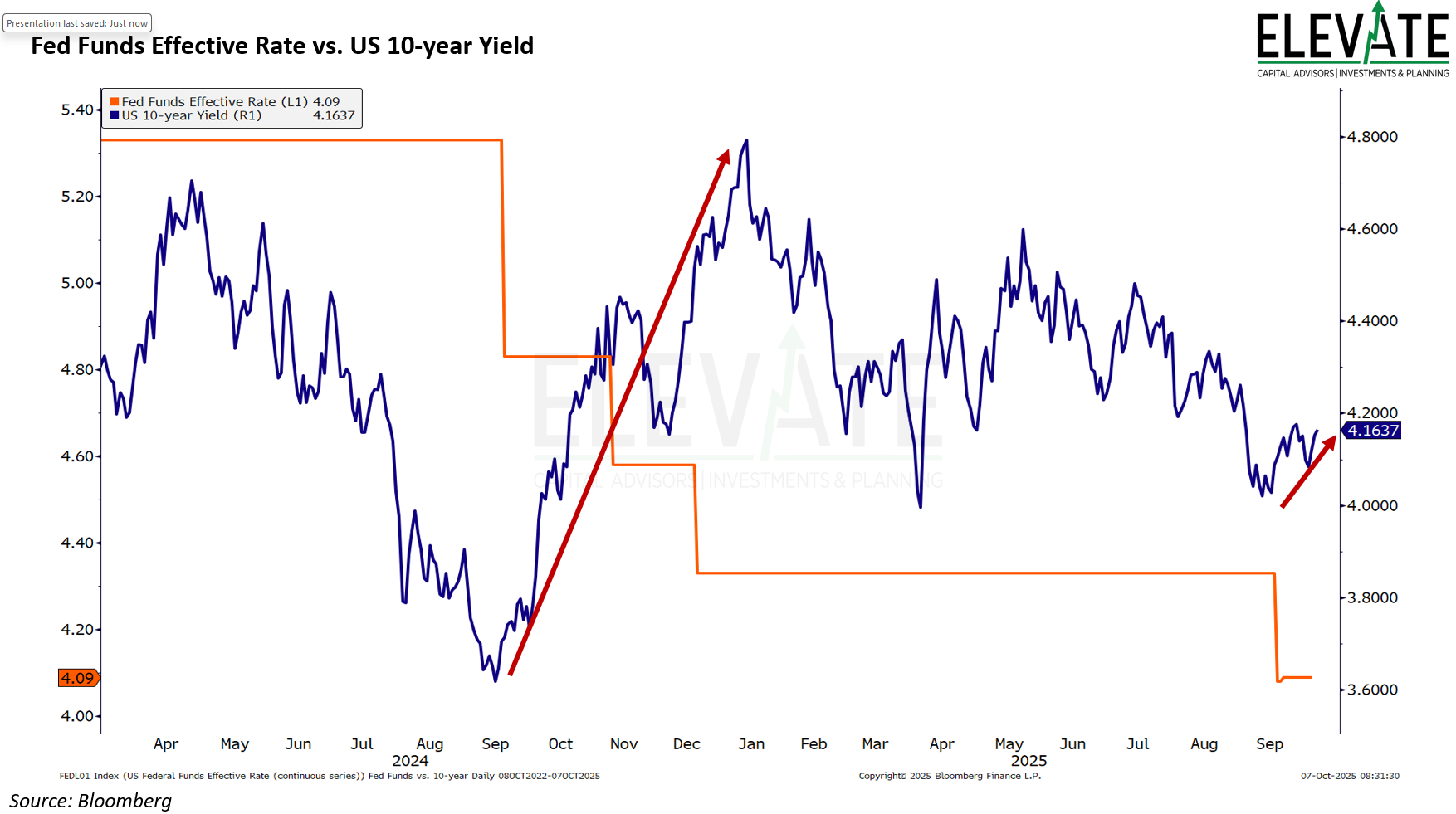

Before I move on, I just want to remind you that the Fed cutting its policy rate does not necessarily translate to lower interest rates in the general economy for things like vehicles or homes. The 10-year US Treasury yield is often referred to as the most important “price” in the world. It sets the tone for borrowing costs across the global economy. Mortgage rates, corporate bonds, and even interest rates in other countries are often based on it in some form or another. It also influences asset values by functioning as the “risk-free” rate.

And as I expected, much like in September 2024 when the Fed cut its policy rate and the 10-year treasury yield rose, it has begun to rise again in alignment with the Fed cutting its policy rate last month. Check it out:

And if you look closely, you’ll see that the 10-year yield has remained higher today than it was in September 2024, despite the Fed’s effective policy rate falling from 5.3% to 4.09%. I think this reflects, in part, the market’s expectation of inflation. People borrowing for 10 years need to be compensated for the potential inflation that will arise during that term. Frankly, I do not believe they are being compensated anywhere near enough for the type of inflation we could see over the next 10 years with the level of debt we already have, the deficit spending we are currently committed to, and the interest we must pay on the growing outstanding balance.

It is counterintuitive, but for what it’s worth, recent history says that recessions typically begin after the Fed starts cutting rates.

Shaded red areas are official recessions. Notice how the Fed Fund Rate begins falling before they begin.

Meanwhile, credit card balances are higher than ever, recently surpassing $1 trillion. This is the amount rolling over from one month to the next. Folks are paying an average of 21.16% on that outstanding balance.

Some simple math tells me that works out to about $211 billion per year or $17 billion per month, going to interest.

This interest burden is crushing many Americans. Delinquency rates are rising, and many are living paycheck to paycheck. Google it!

Speaking of Google, check out these Google trends:

Let’s not forget that the government is also now spending an annualized $1.1 trillion/yr on interest alone. Interest payments were $92.69 billion in August.

And we need to borrow $6 trillion more every year to make our budget work. Anyone lending this money to us for more than a year or two at current interest rates needs to have their head examined, which is why, as I mentioned before, central banks around the world now prefer gold.

I know that none of this is fun or exciting to discuss, especially when the market is partying like it’s 1999. I am not trying to bring anyone down, and I certainly am not suggesting that you, or we, should sell everything and wait for the market to crash. In fact, quite the opposite. Let me reassure you that basically everyone in the market knows these things, and nobody even remotely cares. YET!

Someday, the market will care. However, in the meantime, the market is focused on AI financing loops, which are similar to the dot-com era advertising loops, where one dot-com would take investor money and buy advertising banners on another dot-com website. And that would just go on and on with the same investment dollar generating advertising revenue for several companies.

This time around, I think it is much crazier.

Last month, Oracle’s stock spiked 40% partly on news that OpenAI would spend $60 billion annually for five years, totaling $300 billion on cloud services. There are a couple of problems with this. First, OpenAI doesn’t make any money. In the first half of 2025, it lost $13.5 billion. Second, the cloud computing facilities that would deliver these services haven’t been built yet. Third, there isn’t enough energy to power facilities on this scale even if they did exist. However, the market is pricing the stock as if these sales have already been booked and the money is in the bank.

Yesterday, there was another deal announced where OpenAI agreed to spend “10s of billions of dollars” on AMD chips over the next “several years.” Projections vary, but let’s say it’s $100 billion over four years. Again, we already know that OpenAI doesn’t have that kind of money. It will need to be raised through new investments. In this case, the announcement described the number of GPUs (Graphic Processing Units, or chips) in terms of energy, which is unusual.

They said it would be “6 gigawatts of AMD Instinct GPUs.”

A gigawatt is a unit of power, equal to 1 billion watts, which has nothing to do with computing speed. So, when they say 6 gigawatts of GPUs, they are referencing the electrical power capacity required to run those GPUs, not their computational performance. And guess what… this power doesn’t exist. And the amount of time it would take to bring that much new power online is probably a decade or more, optimistically.

For reference, the Vogtle Nuclear Power Plant in Georgia has four reactors, two of which were just completed in 2025. It is the largest such facility in the country. At full capacity, it can generate 4.5 gigawatts of power. Permitting began for the two new units (Units 3 and 4) in 2006. So, that 2 gigawatts of energy took over 19 years to bring online!

Therefore, the 6.5 gigawatts of GPUs will require roughly 6.5 large nuclear reactors to operate, assuming OpenAI has the funds to purchase them.

The market does not care. AMD’s market cap rose by $101 billion in a day! The market considers it a sure thing.

I am telling you, I have seen this movie before. I know how it ends. But I don’t know when it ends.

It would appear that it isn’t over yet. If the market is correct in partying like it is 1999, and if we look at 1999 as an example, we’ll see that the Nasdaq was already in bubble territory as the calendar flipped from 1998 to 1999. And from there, the Nasdaq rose by a staggering 139% from January 1999 to its eventual peak in March 2000, before falling 80% back to reality, and where it traded in early 1997.

Many highly respected and even legendary investors are sounding the alarm on this issue. It isn’t just me. But again, just because everyone knows something doesn’t mean that anyone cares about it. We’ll continue to stay long our best ideas and mind our stops appropriately.

Speaking of stops, we did stop out of a few positions in September. These are world-class companies that are being left behind because they aren’t part of the circular AI investing phenomenon, among other things.

Not all of you owned these companies. Some of you may have owned all of them, and others may have owned none. That is the beauty of our portfolio strategy at Elevate – we don’t have to invest everyone’s money in the exact same businesses. You are all unique, and so should your portfolios be, at least to a certain extent.

At any rate, I thought it would be nice to review what we have bought and sold over the past month, and perhaps from now on, any interesting press releases or news that may have impacted the companies we own.

I will begin by reviewing what we closed during September. We exited four positions: Kimberly-Clark (KMB), Roper Technologies (ROP), Sprouts Farmers Market (SFM), and McCormick & Co. (MKC). We still have some clients who hold positions in some of these stocks because they bought in at a later date and at a lower price, and therefore have not hit their stops. These are all world-class businesses that have fallen out of favor for one reason or another. If we can repurchase them at a fair price once they have bottomed and begin to rebound, we’ll absolutely consider doing so if we have the cash.

We added positions in:

ACN (Accenture) – A global consulting and technology services firm that helps businesses modernize operations and adopt digital solutions.

CPRT (Copart) – An online vehicle auction platform specializing in salvaged and used cars for dealers, dismantlers, and exporters.

LLY (Eli Lilly) – A leading pharmaceutical company focused on innovative treatments for diabetes, oncology, and neuroscience.

KNSL (Kinsale Capital Group) – A specialty insurer providing excess and surplus lines coverage for hard‑to‑place risks.

ACGL (Arch Capital Group) – A global insurance and reinsurance provider with strong expertise in mortgage and specialty lines.

JOBY (Joby Aviation) – An electric vertical takeoff and landing (eVTOL) aircraft developer aiming to revolutionize urban air mobility.

ASTS (AST SpaceMobile) – A satellite communications company building a space‑based cellular broadband network for direct‑to‑device connectivity.

OKLO (Oklo Inc.) – A nuclear energy startup developing compact, advanced fission reactors for clean, reliable power generation.

SMLF (iShares US Small-Cap Multifactor ETF) – An exchange-traded fund that invests in US small-cap stocks selected for multiple factors like value, quality, momentum, and size to seek enhanced risk-adjusted returns.

Again, not all of you are invested in all of these companies, and some of you, if you didn’t have any cash available, may not have invested in any of them. Some of these positions are highly speculative and only fit in aggressive or growth-focused portfolios. Others are wonderful, slow-growing businesses that trade at a fair price, and we plan to evaluate them over a five-year (or more) timeframe. The companies that find their way into your personal portfolio are a function of your risk tolerance.

And finally, how could I finish without mentioning that the government is shut down!

Source: The Babylon Bee

Historically, markets tend to take these events in stride. Since 1950, we’ve seen 22 shutdowns, each lasting about 8 days on average. During the shutdown itself, the S&P 500 typically trades sideways. However, once the government reopens, the next 12 months tend to be strong, averaging a 12.7% gain, with positive returns occurring 19 out of 22 times. The longest shutdown on record happened during Trump’s first term and stretched 34 days. Interestingly, the S&P rose 10.3% during that period and went on to post a 23.7% return over the following year.

Source: Porter & Co.

I hope you found this commentary both useful and enjoyable. Please tell me what you think - good, bad, or otherwise.

Would you recommend it to people you know? Why or why not? What about our portfolio management and financial planning services?

Click here and let me know!

Until next time, I thank God for each of you, and I thank each of you for reading this commentary.

Clients, I encourage you to click here to access your personalized performance portal and see how your portfolio performed compared to the market's last month.

Shane Fleury, CFA

Chief Investment Officer

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.