A Comprehensive Framework for Financial Planning: Defense

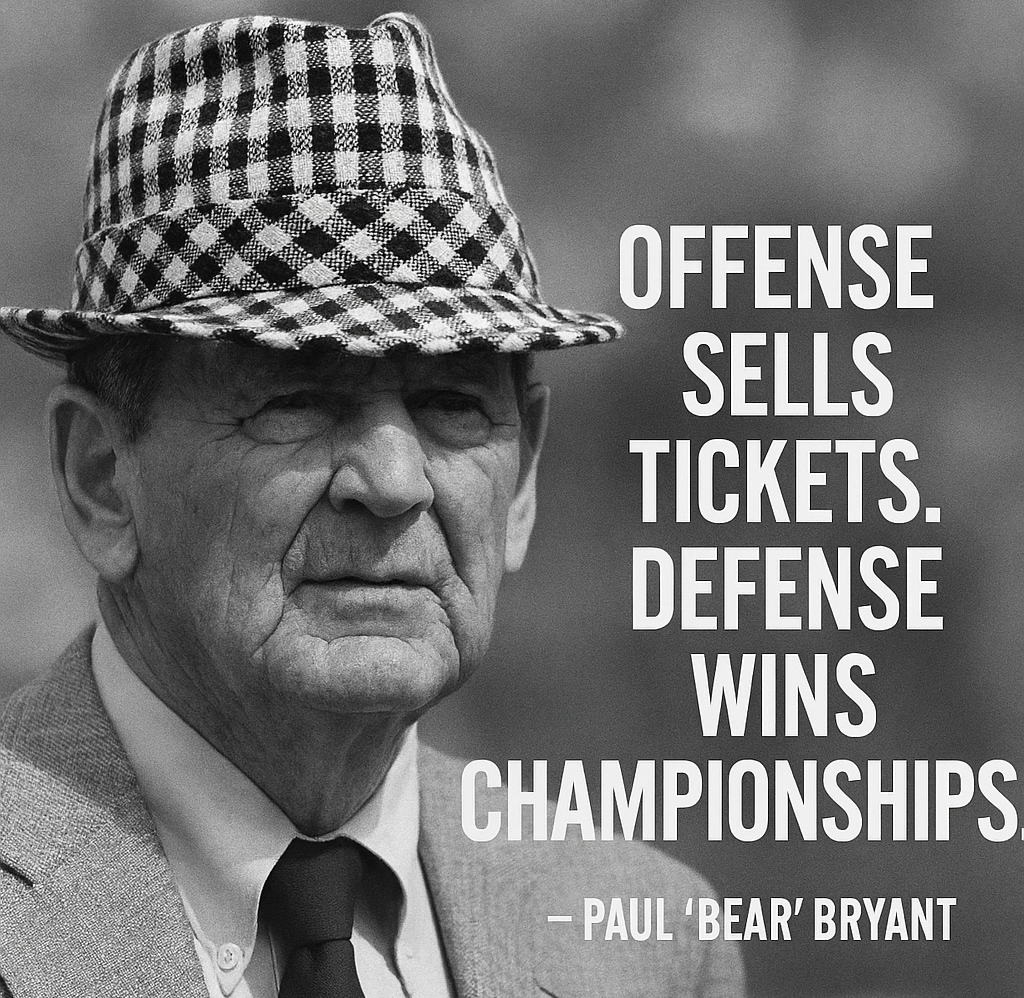

“Offense sells tickets. Defense wins championships.”

In the wealth management business, everyone wants to talk about which stocks are the hottest and where the market is heading next. If you have not had the chance to read my commentary on offense, you can find that here. While those conversations may be fun, making money investing is only one aspect of wealth building. As I noted in June, having a sound strategy for building wealth is essential, but it must be accompanied by an equally sound strategy of protecting what you have already built. Today, I’ll dive deeper into defensive strategies including estate planning, business entity structures, and insurance.

Estate planning is the process of preparing for the management and distribution of an individual's assets and liabilities during their lifetime and after death. It involves creating legal documents such as wills, trusts, powers of attorney, and healthcare directives to ensure that one's wishes are followed regarding the transfer of property, care in case of incapacity, and guardianship of minor children or dependents. This planning helps avoid the default distribution of assets by state intestacy laws and the potentially lengthy, costly, and public probate process, which is the legal procedure for administering a deceased person's estate.

Property passes after death by one of three ways: title, contract, or will (probate). Title is the way property is owned. You might own a piece of real estate individually or jointly with another person.

Let’s walk through a few examples…

Jack and Jill are married and the home they live in is solely in Jack’s name. Jack dies, having written a will and naming Jill as the beneficiary of all his possessions, including the home they live in. Jill will inherit the home but only after a potentially lengthy, expensive probate of Jack’s estate.

What if Jack dies without a will? Jill will be entitled to a significant portion of the estate, but not necessarily the entire home, depending on the state's intestacy laws and the presence of other heirs. Few people think this is possible, but it is.

One way to avoid both these scenarios is to own the home jointly. JTWROS is the common term, meaning Joint with Rights of Survivorship. Using this titling, Jill automatically “inherits” the home without having to deal with expenses and delays of probate court.

In the context of estate planning and passing property after death, contract refers to naming a beneficiary of an asset. If you own life insurance, naming an individual such as a spouse or child will ensure the death benefit proceeds go directly to that spouse or child upon death. If you have no named beneficiary, or name your estate as beneficiary, the proceeds will accrue to your estate and be subject to the probate process.

With retirement plans, it is best to name a beneficiary to ensure the account assets transfer directly to the person or people you intend vs to your estate. This is not only most efficient, but it can also reduce income tax liability.

Adding a Transfer on Death (TOD) or Payable Upon Death (POD) designation to an account is also advantageous. A TOD designation is typically used for non-retirement investment accounts, such as brokerage accounts, stocks, or bonds. It allows the account owner to name a beneficiary who will automatically inherit the account’s assets upon the owner’s death. The assets transfer directly to the beneficiary without going through probate, ensuring a faster and less costly transfer. A POD designation is commonly applied to bank accounts, such as checking, savings, or certificates of deposit (CDs). Similar to TOD, it allows the account owner to designate a beneficiary who will receive the account’s funds directly upon the owner’s death, avoiding probate.

The last way property passes after death is via probate. Probate is the legal process through which a deceased person’s estate is administered and distributed under court supervision. Probate assets are assets of the deceased’s estate that do not pass via title or contract. The probate process, while potentially time consuming and expensive, ensures that the deceased’s assets are distributed to heirs according to their wishes or state law.

For some people, typically those with estates large enough to be worthy of the effort required to protect, trusts can be useful tools. Trusts can help avoid probate, provide asset protection, provide greater control over how and when assets are distributed, and allow seamless management of assets in the event of incapacity.

A trust is nothing more than a legal arrangement where one person (the trustor or grantor) transfers assets to another person or entity (the trustee) to manage for the benefit of a third party (the beneficiary). The trustee holds and manages the assets according to the trust’s terms, ensuring they are used as the trustor intended, often to avoid probate, protect assets, or control distribution. For example: a parent (trustor) creates a trust, places their savings in it, names a trusted friend (trustee) to manage it, and specifies that the funds go to their child (beneficiary) when they turn 25.

A power of attorney (POA) is a legal document that allows one person (the principal) to give another person (the agent or attorney-in-fact) the authority to make decisions or take actions on their behalf. The scope can include financial, legal, or medical matters, depending on the type of POA. For example: you (the principal) create a POA naming your sibling (the agent) to manage your bank accounts if you’re unable to do so due to illness or incapacity. The agent acts in your best interest based on the POA’s terms. POAs can be general (broad authority) or limited (specific tasks). They can be standing or springing. A standing POA is effective immediately upon execution by the principal. A springing POA does not become effective until the occurrence of a qualifying event, such as incapacity. A POA ends upon the principal’s death or revocation, unlike a trust, which can continue after death.

Estate tax planning is the process of arranging your finances and assets during your lifetime to minimize the taxes your estate or heirs will owe after your death. It involves strategies like gifting, setting up trusts, or using exemptions to reduce the taxable value of your estate, ensuring more wealth passes to your beneficiaries. For example: you gift money to your children each year within the IRS’ annual gift tax exclusion limit ($18,000 per person in 2025) to reduce your estate’s size, lowering potential estate taxes.

In my opinion, neglecting estate planning, or doing it with a minimum amount of thought, is very selfish. When people die, the emotional and financial impact on people they leave behind is often devastating. Even when someone has done a good job of crossing T’s and dotting I’s, it is very difficult on heirs. The process of administering an estate is often time consuming at best, and time consuming and expensive at worst. I strongly encourage you to make time for this very important planning. Doing a good job is not difficult once you decide to do it well. If your estate is minimal and you need to keep cost to a bare minimum, consider using an online legal tool. If your estate is larger, spending a few thousand dollars now can save tens or hundreds of thousands of dollars later. If you need a recommendation for an excellent attorney to help you, please email me at ken@elevatecapitaladvisors.com and I’ll be happy to help.

Let’s move on to business entity structures.

Choosing the right business structure, such as an LLC, S Corp, or C Corp, is critical for protecting personal assets from business liabilities by creating a legal separation between the business and its owners.

A Limited Liability Company (LLC) provides flexibility in management and taxation, allowing owners to choose pass-through taxation (like a sole proprietorship) or corporate taxation, which can optimize tax planning while maintaining liability protection. This structure is ideal for small to medium-sized businesses seeking simplicity and strong asset protection. In contrast, S Corporations (S Corps) and C Corporations (C Corps) also provide liability protection by establishing the business as a separate legal entity, but they differ in taxation and complexity. An S Corp offers pass-through taxation, avoiding double taxation (where the business and shareholders are both taxed), and limits personal liability, making it suitable for businesses with steady income and up to one hundred shareholders. A C Corp, while also protecting personal assets, is subject to double taxation, corporate income tax and shareholder dividend tax, but is preferred for larger businesses seeking investment or global operations due to its ability to issue multiple stock classes. Both corporate structures require more formalities (e.g., board meetings, bylaws) than an LLC, but they equally shield personal assets from business liabilities, provided owners maintain proper separation (e.g., avoiding commingling personal and business funds). Choosing the right structure depends on the business’s size, goals, and tax strategy, but all three can effectively safeguard personal wealth when properly managed.

By default, single member LLCs are taxed as sole proprietorships. Income and losses are reported on the owner’s personal tax return (Form 1040, Schedule C), and the owner pays income tax and self-employment tax (15.3% for Social Security and Medicare) on the business’s net income. This is simple but may result in higher self-employment taxes.

Multi-Member LLCs are taxed as a partnership by default. The LLC files an informational return (Form 1065), and profits/losses pass through to the members’ personal tax returns (Schedule K-1). Each member pays income tax and self-employment tax on their share of the profits, based on the LLC’s operating agreement or ownership percentages.

LLCs can also elect to be taxed as either an S or C corporation.

S Corporation Election: An LLC can elect to be taxed as an S Corp by filing IRS Form 2553. This allows pass-through taxation, where profits and losses flow to the owners’ personal tax returns, avoiding corporate income tax. However, owners who actively work in the business can pay themselves a “reasonable salary” (subject to payroll taxes) while taking additional profits as distributions, which are not subject to self-employment tax.

C Corporation Election: An LLC can elect to be taxed as a C Corp by filing IRS Form 8832. The business pays corporate income tax (21% federal rate in 2025) on its profits, and owners pay personal income tax on dividends or salaries received, leading to potential double taxation. This is less common for small LLCs but may suit businesses planning to reinvest profits or seek large-scale investment, as C Corps have no shareholder restrictions. The LLC’s legal structure remains unchanged, but it follows C Corp tax rules.

A succession plan is a critical safeguard for a business owner, ensuring that the sudden loss of their leadership (due to death, disability, or unexpected departure) does not plunge his or her family into financial ruin. Without one, the business may falter from operational chaos, lose key clients or employees, or face forced liquidation at fire-sale prices, eroding the wealth that supports the family's lifestyle, education funds, or retirement. By contrast, a well-crafted plan designates trained successors, outlines clear transition protocols, secures buy-sell agreements funded by life insurance, and minimizes tax burdens through trusts or gifting strategies, preserving the enterprise's value and generating steady income streams. This proactive measure transforms potential catastrophe into continuity, shielding loved ones from debt, disputes, or dependency on unreliable government aid; and allowing the owner's legacy to endure as a source of security rather than strife.

Insurance is the last defensive topic I’ll cover in this planning commentary. We’ll start with property and casualty (P&C) insurance. Maintaining appropriate amounts of P&C insurance serves as a foundational shield against catastrophic financial loss. High-value homes often contain irreplaceable assets such as fine art, jewelry, custom furnishings, and expensive technology, whose replacement costs far exceed standard policy limits. Specialized high-net-worth policies with agreed-value coverage and blanket limits ensure full reimbursement without depreciation disputes. Personal liability umbrella policies can protect the family’s wealth from lawsuits exceeding automobile coverage limits, dog bites, or defamation claims amplified by social media. The presence of teenage drivers introduces acute auto-related risks that standard policies inadequately address for affluent families. Inexperienced drivers statistically face higher accident rates, and a single at-fault collision involving a luxury vehicle or severe injury can easily trigger claims exceeding typical policy limits. Critically, proper P&C insurance prevents the family from subsidizing gaps through self-insurance, an inefficient use of capital better deployed in investments, while signaling to lenders and trustees that risk is professionally managed, enhancing credit terms and estate-planning flexibility.

Life insurance is an extremely efficient tool for ensuring surviving families or business partners don’t suffer financial hardship should a breadwinner or business owner die prematurely. There are three basic types of life insurance (and variations of each type). Term life insurance provides pure death-benefit protection for a fixed period—typically 10, 20, or 30 years—at the lowest initial cost, making it ideal for young families or business owners needing large coverage amounts to replace income, pay off a mortgage, fund college, or secure a business loan during peak financial-responsibility years. Think of term insurance like leasing a home. You have coverage while you pay the premiums, but it goes away at the end of the term. When you lease a home, you have a place to live while you pay the rent but have no equity and no place to live, at the end of the lease. Whole life insurance, a form of permanent coverage, builds guaranteed cash value at a fixed interest rate while locking in level premiums for life, proving valuable for high-net-worth individuals seeking to fund estate-tax liquidity, create tax-deferred wealth accumulation, or leave a legacy to heirs or charity without market risk. Universal life insurance, another form of permanent insurance, offers flexible premiums and adjustable death benefits with cash value tied to current interest rates or indexed accounts. This may suit affluent policyholders who want lifelong protection plus the ability to overfund for tax-advantaged growth, skip premiums during cash-rich years, or dial coverage up or down as estate-planning needs evolve—though it requires active management to maximize value. Both whole life and universal life offer tax deferred growth of cash surrender value, often referred to as equity, and potentially tax-free distributions for real estate purchases, education funding, retirement income, or any other reason.

Remember the Aflac duck? AFLAC! He would shout. The duck referred to it as supplemental insurance but most people call it disability insurance. Disability is insurance that replaces a portion of a person’s income, typically 50%-60% should they become unable to work due to illness, injury, or mental health conditions. This ensures financial stability during recovery or prolonged disability. A tailored policy with cost-of-living adjustments and non-cancelable terms safeguards the family’s financial plan, prevents depletion of wealth, and complements other protections like life or umbrella insurance. If you were to become disabled, your income would go away but your expenses wouldn’t. In fact, they would go up. If you would find it difficult, or impossible, to run your business or do your job should you suffer a disability, you should strongly consider having disability insurance. Your family will thank you for making sure they can live with dignity even if you can’t work.

Long-term care (LTC) insurance is insurance that will either pay you cash or reimburse you for expenses for care should you not be able to perform two or more of the six activities of daily living (eating, bathing, dressing, toileting, continence, transferring) or suffer cognitive impairment that requires supervision to maintain your safety. Care can be in your own home, assisted living, or skilled nursing facility (aka nursing home). LTC insurance is a crucial consideration to protect substantial assets from the staggering costs of care, often exceeding $100,000 annually for nursing homes or $50,000 for home care which can rapidly deplete retirement savings or force liquidation of investments, real estate, or business interests at inopportune times. By covering these expenses, LTC insurance preserves wealth for heirs, maintains financial independence, and ensures quality care without burdening family members. Caregiving is exhausting, particularly for a similarly aged spouse. Insurance companies sell either traditional LTC insurance which is like term insurance, or hybrid products like life insurance with a long-term care rider. Life/LTC policies have become very popular because unlike traditional LTC insurance, most policies ensure either the insured, the insured’s beneficiaries, or a combination of the two will get back at least as much as was paid in premiums, if not substantially more. Purchasing this type of policy during working years, ideally in one’s 40s or 50s, locks in lower premiums and safeguards against future health declines that could make coverage unattainable.

I believe that while building wealth through investments is critically important, protecting what you’ve already built is the true key to financial security, much like a strong defense wins championships in sports. I advocate for comprehensive estate planning, using tools like wills, trusts, powers of attorney, and beneficiary designations (such as TOD/POD) to ensure your assets transfer smoothly to heirs, bypass the costly and public probate process, and minimize estate taxes. I’ve seen how intestacy laws can disrupt families’ plans. I also stress the importance of choosing the right business entity structure, like an LLC for flexibility and simplicity, an S Corp to avoid double taxation, or a C Corp for larger ventures, all of which shield your personal wealth from business risks when properly managed. Most critically, I urge clients to secure robust insurance—high-net-worth P&C policies with umbrella coverage to protect against lawsuits or property loss, life insurance (term for affordability, whole or universal for lifelong tax and death benefits), disability income to replace lost earnings, and long-term care (LTC) to cover exorbitant care costs that could otherwise drain estates. For business owners, I emphasize a succession plan to prevent operational chaos or forced liquidations, using buy-sell agreements and trusts to ensure your family’s financial stability and preserve your legacy. These defensive strategies, in my view, are non-negotiable to safeguard your wealth and loved ones from unforeseen disasters.

Ken Armstrong, CFP®, RICP®, ChFC®, CLU®, CASL®, CLTC

CEO & Senior Wealth Management Advisor

Elevate Capital Advisors

Legal Information and Disclosures

This commentary expresses the views of the author as of the date indicated and such views are subject to change without notice. Elevate Capital Advisors, LLC (“Elevate”) has no duty or obligation to update the information contained herein. This information is being made available for educational purposes only. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Elevate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. This memorandum, including the information contained herein, may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Elevate. Further, wherever there exists the potential for profit there is also the risk of loss.